Rising construction costs hit profits as sales slow

The "golden era" for China's housing market is over, though the real estate industry is still more profitable than manufacturing, an executive of the country's biggest residential property developer said over the weekend.

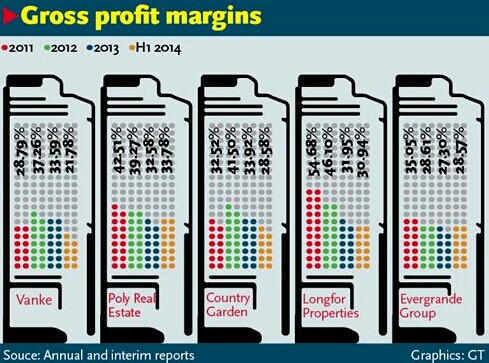

"Developers have turned to 'earning sliver' from 'earning gold' previously (meaning a drop in profitability), but they are still performing better than those in the manufacturing sector, chinanews.com reported Sunday, citing Yu Liang, president of China Vanke Co.

Yu's comments come amid a cooling property market, which has witnessed falling house prices, sales and investment.

The average net profit margin of 202 listed Chinese property developers was 14.17 percent in the first half of 2014, according to data compiled by real estate consultancy rem.com.cn.

In comparison, the average profit margin of China's top 500 manufacturers in terms of revenue was merely 2.7 percent in the same period, said a report released by the China Enterprise Confederation on September 2.

The property industry's average net profit margin is likely to touch the "red line" of 10 percent by 2015 and the industry is set to enter a period of "moderate profitability" after that, the consultancy estimated in a research note released earlier this month.

"Property developers used to earn big profits by selling apartments or hoarding land for speculative purposes," Yan Yuejin, a researcher with the E-House Real Estate Institute, told the Global Times Sunday.

As China's property market has started to cool down, rising building costs and high land prices are eating into the developers' profits, Yan said.

Nearly 53 percent of the 202 listed property developers saw a year-on-year decrease in their net profit growth rates in the first half of this year, up from 31.5 percent a year earlier, according to data from rem.com.cn.

A growing number of small property developers have reportedly faced bankruptcies, runaway or halted projects.

A total of 32 property developers in Handan, North China's Hebei Province were found to have illegally raised funds worth 9.3 billion yuan ($1.5 billion), after some of them defaulted on the loans, the Xinhua News Agency reported on September 22.

"More small property developers will face default risk in the fourth quarter, as financial institutions become increasingly cautious in lending to them," said Zhang Hongwei, research director at Shanghai-based property consultancy ToSpur.

"We will also see large developers grabbing more market share through acquisition of smaller developers," he told the Global Times Sunday.

Despite recent moves by local governments to ease or cancel home purchase restrictions, analysts are still bearish about house sales in September and October - traditionally the peak season for the housing market.

"The easing of home purchase curbs will not boost house sales significantly, with only Hohhot posting an obvious market rebound and a few cities including Wenzhou, Hangzhou and Chengdu seeing short-term surges in house transactions," property brokerage Centaline Group said in a research note on Thursday.

Property developers are expected to cut home prices to boost sales in the coming months, estimated Zhang from ToSpur.

But he warned that the tight mortgage policies and wait-and-see attitude of prospective homebuyers might dampen housing demand.

There is increasing market expectation for further policy easing in the property market, after media reports said China's Big Four banks are considering relaxing mortgage policies to boost lending to homebuyers.

Liu Shiyu, deputy governor of the People's Bank of China, told reporters in Shanghai Thursday to "wait for the document on details" when asked if the mortgage policies will be adjusted, and noted that the central bank is determined to "adjust economic structure and benefit the people's livelihood."

Chinese home prices remain under pressure: Moody‘s

2014-09-28Another city lifts property restrictions

2014-09-28Home mortgage rumors fall flat with experts

2014-09-26Big Four banks refute reports on relaxation of home loan restrictions

2014-09-24Home prices enter downward spiral

2014-09-23Home prices decline in more Chinese cities

2014-09-18August new home price falls for 4th month

2014-09-02Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.