Says has outstanding accounts receivable in response to overdue loans report, but operations still normal

Sinosteel Corp, a leading State-owned steel trader, admitted on Tuesday that the company is struggling with financial issues amid an ongoing steel industry downturn, domestic news portal finance.qq.com reported.

Sinosteel confirmed that it failed to recover some of its accounts receivable, but that its operations are still going on as normal, according to the report, in response to media allegations that the company's overdue bank loans have reached tens of billions of yuan, involving Industrial and Commercial Bank of China (ICBC) and Bank of Communications (BOCOM).

In response to this, ICBC was quoted by people.com.cn on Tuesday as saying that ICBC only accounted for 1.3 percent of Sinosteel's total loans, and Sinosteel so far has not defaulted on loans provided by ICBC.

Calls and an e-mail inquiry made to Sinosteel from the Global Times remained unanswered and neither ICBC nor BOCOM could be reached by press time.

Analysts attributed Sinosteel's problem to the gloomy steel industry as well as the company's unprofitable overseas investments.

"Sinosteel has devoted a lot of effort to the acquisitions of iron ore projects around the world, but at present none of its investments have made any big fortune yet," Hu Yanping, an industry analyst at Beijing-based steel information provider custeel.com, told the Global Times Tuesday.

For instance, in 2005, Sinosteel announced it would co-develop the Weld Range iron ore mining project in Australia with local mineral company Midwest. But the $2 billion project was suspended in 2011 due to setbacks in the development of the Oakajee port and rail project, which was reportedly expected to be completed in 2015 and cost Sinosteel $100 million per year.

Sinosteel had revenue of 139.9 billion yuan ($22.8 billion) in 2013, down from 149.7 billion yuan a year earlier, according to the company's annual sustainability reports on its website.

Hu noted that those unsuccessful investments would continue putting significant pressure on the company's cash flow, especially when steel trading, its core business, has also been dampened by the declining steel price.

In the week ended on Friday, China Steel Price Index stood at 87.6 points, the lowest in the past three weeks, according to a report by China Iron and Steel Association (CISA) issued on Tuesday.

Other steel firms did not perform well either. Baoshan Iron and Steel Co, China's biggest listed steel maker by stock market value, saw a 14.82 percent drop year-on-year in its net profit in the first half of the year, hitting 3.2 billion yuan.

Highsee Group, based in North China's Shanxi Province and the largest private steel manufacturer by output, was reportedly on the verge of bankruptcy with debts of at least 3 billion yuan.

China would likely see more and more steel companies, either privately owned or State-backed, being confronted with the same problems as Sinosteel does in the following years, Wang Guoqing, director with Beijing Lange Steel Information Research Center, told the Global Times Tuesday.

"Many steel companies in the country have a very high debt-to-asset ratio, while overcapacity and sluggish demand continue to plague the whole industry," said Wang.

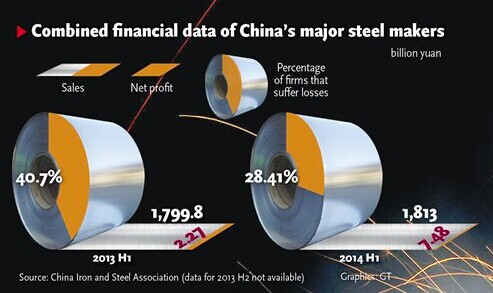

Data from the CISA shows in late August that in the first half of the year, 88 major steel companies in China monitored by the association recorded net profit of 7.48 billion yuan in total, up from around 2.27 billion yuan over the same period in 2013, but among them, 19 firms had a high debt-to-asset ratio of more than 80 percent.

Wang noted that the firms will face more financial pressure in 2015 when the new version of the environmental protection law, widely perceived to be the strictest in China's history, would come into effect to push heavy-polluting industries into upgrading and reformation.

Both Hu and Wang noted that the government will not refuse to aid State-owned companies such as Sinosteel. An unnamed source familiar with Sinosteel's matter was quoted by finance.qq.com as saying that the central government would invest 20 billion yuan to bail Sinosteel out.

According to information on the company's website, Sinosteel is under the State-owned Assets Supervision and Administration Commission with 63 subsidiaries in China and 23 abroad.

Although State-owned companies would find it easier to receive support from local governments, some private companies may also stand out during industrial upgrading due to advantages from having a more flexible management mechanism, said Hu.

No default of Sinosteel loan: ICBC

2014-09-24Sinosteel making losses from overseas businesses

2012-12-07Last-minute bailout saves firm from default

2014-07-24Chaori default is a welcome move

2014-04-14Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.