The asset quality of major State-owned banks weakened further during the first half of 2014 under the pressure of a slowing economy and restructuring, while their risk exposure expanded to more regions and sectors.

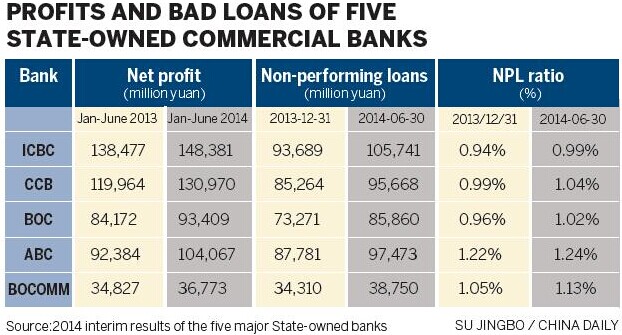

The five largest Chinese lenders had 423.49 billion yuan ($54.64 billion) in nonperforming loans as of June 30, up 49.18 billion yuan from Dec 31. Their average NPL ratio went up 5 basis points to 1.08 percent.

Commercial banks reported a total of bad loans of 694.4 billion yuan on June 30 with an average NPL ratio of 1.08 percent, the China Banking Regulatory Commission said in a statement.

Zhang Hucheng, president of a Beijing-based asset management company, said that small developers in some regions were having trouble repaying bank loans because of difficult conditions in the housing market. Problems among developers were a major cause for the decline in banks' asset quality.

In addition, some companies in the coal and steel industries have gone out of business. Small and medium-sized enterprises are also finding it tough to survive, further raising banks' risks.

In Jiangsu, Zhejiang and Fujian provinces, some homeowners have even stopped paying their mortgages. And certain steel trading companies, wholesalers and retailers are facing liquidity problems.

"The average NPL ratio for the banking sector will continue to rise in the second half as housing prices fall further and the economy remains under downward pressure," Zhang said.

The NPL problem expanded from its former epicenter of the Yangtze River Delta region to wider areas, including the Bohai coastal region touching Shandong, Hebei, Tianjin and Liaoning in northern China. Other rapid increases were seen in the Pearl River Delta region and the western region in the first half of 2014.

Several major banks said NPLs surged in the manufacturing sector as well as in wholesale and retail trade.

Industrial and Commercial Bank of China Ltd had a 15.7 percent increase in NPLs involving the wholesale and retail trade in the first half. Its NPL ratio in the sector reached 3.62 percent on June 30, up 22 basis points from Dec 31.

China Construction Bank Corp reported a 13.6 percent rise in NPLs to the manufacturing sector. Its NPL ratio in this sector rose by 30 basis points to 3.18 percent.

Apart from real estate, bad loans in sectors such as steel trading also triggered concerns. Risks in trade financing also extended to commodities such as coal, copper and iron ore.

Lian Ping, chief economist with Bank of Communications Co, said the business environment has continued to worsen for industries with excess capacity and has started to affect companies upstream.

Tough conditions have led to defaults by some medium-sized and large enterprises whose business relies heavily on natural resources, Lian said.

Financial risks are also spreading quickly among micro-sized and small enterprises in certain regions. Mutual loan guarantees among small businesses can easily have a ripple effect if the risks are not quarantined, Lian said.

For some commercial banks, special-mention loans (potentially weak loans for which there may not be sufficient documentation, for example) also increased significantly in the first half. At Bank of Communications Co, such loans hit 74.6 billion yuan on June 30, up 26 percent from Dec 31 and up 14.8 percent year-on-year. Those rates were far higher than the single-digit growth in total loans during the corresponding periods.

"Commercial banks are still facing downward pressure in terms of asset quality. Their bad loans will keep growing for at least six to nine months due to the lagging effect of increases in special-mention loans," Lian said.

He estimated that NPL ratios are likely to climb to a range of 1.14 percent to 1.19 percent at the end of this year.

Commercial banks accelerated NPL write-offs. In the first half, 16 banks listed in the A-share market wrote off bad loans worth 71.05 billion yuan, which was close to the amount of 83.25 billion yuan for the whole year in 2013.

Five major State-owned banks accounted for the largest proportion of write-offs, or 46.91 billion yuan.

The banks will make greater efforts to resolve and write off bad assets in the rest of the year, Lian said.

With both bad loans and NPL ratios increasing in the first half, net profit growth for three major State-owned banks - the Industrial and Commercial Bank of China, China Construction Bank and Bank of Communications - fell to single-digit levels.

ICBC profit slows, bad loans rise

2014-08-29BOC reports 11 pct profit growth in H1

2014-08-20CCB announces 2013 profit gains

2014-03-31ABC posts disappointing first-half results

2014-08-27Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.