Central bank moves to reassure market

There was surprise at the extent of the slide in the amount of credit extended by banks in July, revealed by central bank data published on Wednesday, adding to worries about the durability of the economy's recovery.

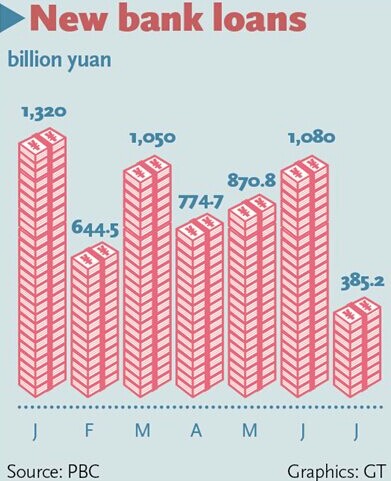

New yuan loans came in at 385.2 billion yuan ($62.54 billion) in July, well below 1.08 trillion yuan the month before, according to data released by the People's Bank of China (PBOC), the country's central bank.

The weakest numbers came in the total social financing aggregate, a broad measure of liquidity in the economy, which was only 273.1 billion yuan for July, the lowest since October 2008 and far below the 1.97 trillion yuan of the previous month, PBOC statistics showed.

Economists had expected some retreat in July's financing data after unexpected growth in June, but such a slump took the market by surprise.

In a rare statement, released shortly after the results, the central bank read into the weak credit data, reassuring the market that growth in credit extension was still within a reasonable range.

The regular seasonal drop from June to July was exacerbated by the stronger-than-anticipated June data.

Downward pressure on economic activity and a property sector that is facing changes have weighed on effective demand for loans, said the central bank statement. It added that increased alertness in credit extension in light of the continuing buildup of bad loans has had an impact on growth.

The observation of financial operations should not be constrained to fluctuations of indicators over one single month, the central bank said in the statement. "The orientation of the monetary policy to ensure 'total stability, structural optimization' remains unchanged."

Economists, stunned by the credit data, expressed confusion and concern despite the central bank's reassurances.

Insufficient supply rather than weak demand might be the cause of the surprising data, Lu Zhengwei, chief economist at Shanghai at Industrial Bank Co, told the Global Times on Wednesday.

Support measures such as the further loosening of loan-to-deposit ratios and kicking off banks issuing preference shares could be considered to improve bank credit supply, Lu suggested.

The downside in both new loans and total social financing reinforced the view that "China's growth recovery remains fragile and is largely policy-led, not self-sustaining, as domestic demand remains soft," Chang Jian, chief China economist with Barclays Capital, said in a note sent to the Global Times.

Chang believes "more policy easing is unavoidable if the government wants to achieve the 7.5 percent growth target."

Also on Wednesday, a slew of economic indicators were released by the National Bureau of Statistics (NBS) showing the recovery was seen softening, although a spate of government measures have been taken over recent months to buttress the economy.

Urban fixed-assets investment, a significant engine of economic activity, came in short of expectations to register a 17 percent gain in the first seven months over the same period last year, cooling from a 17.3 percent rise in the first half of the year, while retail sales rose by 12.2 percent in July, slightly below forecasts.

The performance of factories appears to be the only bright spot in the data released on Wednesday, with an increase of 9 percent in July's industrial output meeting previous expectations.

The NBS figures, coupled with the sharp fall in credit data announced by the central bank, signify that downward pressures on the economy seem to be on the horizon and continued pro-growth government measures must be adopted in the coming months, Liu Dongliang, a senior analyst at China Merchants Bank Co in Shanghai, said in a research note sent to the Global Times.

Despite the soft readings, the central bank said the daily amount of loans flowing into the economy have been 30-50 billion yuan since August began, hinting at an apparent improvement in credit extended by banks this month.

Lu stressed that policymakers should be mindful of firing further stimulus bullets, as it takes time for pro-growth measures to take their full effect.

Wang Tao, chief China economist at UBS AG in Hong Kong, dismissed concerns over the sustainability of the recovery.

The economy is expected to sustain its growth momentum in the third quarter, as the effect of recent government measures might be seen in the foreseeable future, Wang told the Global Times.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.