China's residential property market witnessed a slowdown in July despite the withdrawal or relaxation of home purchase limits by some local governments to augment the sector.

The sales of residential properties nationwide declined by 9.4 percent in the first seven months year-on-year in terms of floor area, the National Bureau of Statistics (NBS) said Wednesday.

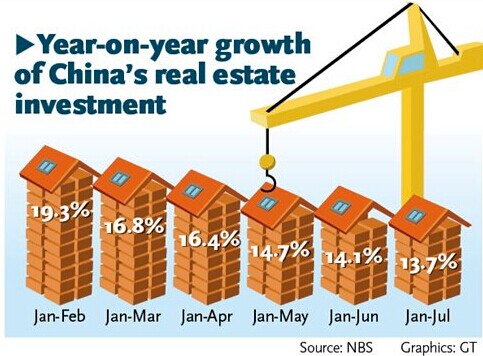

Investment in residential properties nationwide in the first seven months increased by 13.3 percent year-on-year, a drop of 0.4 percentage points compared with the first half, the NBS data showed.

"The decline in home sales is much worse than our expectations," Liu Yuan, senior manager of Centaline Property real estate agency in Shanghai, told the Global Times Wednesday.

As of Wednesday, 29 of the 46 cities which had implemented home purchase limits since 2010 have canceled or relaxed their restrictions, according to media reports.

"More local governments will possibly withdraw or relax home purchase limits to shore up the industry, which is a pillar of the country's economy," Liu said, noting that if the poor performance of the residential property market continued, it will have a negative impact on the country's macro economy.

Four first-tier cities - Beijing, Shanghai, Guangzhou and Shenzhen - are not likely to relax their home purchase limits -before the end of this year because of the large demand for homes in these cities, according to Liu.

"The slowdown in the property market is partly due to the tightened liquidity in the first half," Fan Xiaochong, vice president of Sunshine 100 Real Estate Group, told the Global Times Wednesday.

Chinese banks lent 385.2 billion yuan ($62.54 billion) of new loans in July, down from 1.08 trillion yuan in June, the central bank said Wednesday.

To reverse the downward trend, the central government "will possibly loosen liquidity," Fan noted.

Developers will also take promotional measures like discounts in the remaining months this year, said Fan.

But Fitch Ratings said at a media briefing on August 7 that the loosening of property curbs and the easing of monetary policies in China may unintentionally increase speculation on residential property, which will undermine the restructuring needed to keep the sector healthy.

Scrapping limits may lead to some moderate short-term rebound, but will not reverse the overall downward trend, while further relaxation may pose risks of encouraging and reigniting speculation on residential property for capital gains, as China experienced in 2009, said Andy Chang, associate director of Fitch Hong Kong Ltd.

Contrary to the slowdown of residential properties, commercial properties still witnessed slight growth in July.

Investment in office buildings grew by 19.3 percent in the first seven months from a year ago, up from an annual rise of 19.0 percent in the first half, the NBS said.

Sales of retailing properties rose by 7.4 percent year-on-year in the first seven months in terms of floor space, according to the NBS data.

The China Commercial Real Estate Confidence Index (CCRECI), an index jointly released by INSITE Corporate Research Center and another nine institutions Wednesday, hit 112.1 in the first half of 2014.

A level above 100 indicates optimism.

The index is based on interviews with more than 800 senior industry professionals, over 500 developers and landlords, and over 320 retailers.

Home prices correction is good for economy: spokesman

2014-08-12Prepare for pop of property bubble

2014-05-05Property bubble burst foreseen

2013-11-11Property weakness overhangs recovery

2014-06-14China‘s property market continues to cool off in May

2014-06-13China‘s property climate index drops in May

2014-06-13RRR cut won‘t aid property market

2014-06-11Protests in vain as property market weakens

2014-06-05Govt curbs on property speculation to continue

2014-06-05Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.