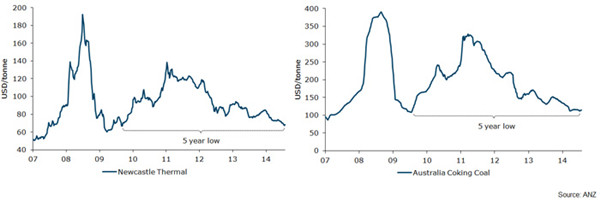

A graph of the price of coal from 2007 to 2014 shows prices are at a five-year low.

China's decision to ban coal-fired power from Beijing and other major cities by 2020 grabbed headlines this week, although it is unlikely to have any meaningful impact on the country's coal consumption.

The four power plants that will close in the capital generate three gigawatts of energy - barely 0.5 per cent of China's annual needs.

"Put another way, they add three gigawatts a week to the thermal power demand," ANZ's head of commodity research, Mark Pervan, said.

"So shutting down the thermal power capacity in Beijing would be replaced within one week in China."

Still, China's decision is one more piece of unwanted news for the battered and bruised Australian coal industry.

Prices for both thermal coal - used for electricity - and coking coal - an ingredient in steel production - are around a third and a quarter, respectively, of what they were in 2008.

And they have plunged close to 15 per cent each in 2014 alone.

While the push towards clean energy has been one factor, analysts say the major issue for the coal industry has been over-supply.

"We've had quite a bit of supply come on from the higher price period before," Morningstar senior resources analyst Mathew Hodge said.

"That's meeting weakish demand, and it's overwhelmed demand so now we've got over-supply. As a consequence, no-one in the industry's really making any money in Australia."

Mr Pervan says supply has so far been unresponsive in Australia, because much of the industry is controlled by big companies with deep pockets, who are prepared to ride out the downturn.

"I think the rub there is that the Australian coal industry is at the top end of the cost curve, so it's these guys who should be making some serious decisions about closing supply," he said.

Shale gas, solar threaten demand for coal

The US shale gas revolution, and the push to renewable energy, are also expected to dampen demand for coal in the decades to come.

Prices for solar continue to fall. It has the potential to be a major disruptor for the coal industry because it can generate power during the most profitable peak hours.

Mr Pervan says he questions the viability of thermal coal in the long term.

"At the end of the day though, in emerging markets it comes down to economics," he said.

"There will be a trade off between that and the environment. And right now it seems to be quite acute in China, where they're burning a lot more coal than anywhere else."

But the present day woes for coal will also have an impact on Australia's trade performance.

Preliminary estimates suggest that Australia exported close to $40 billion of thermal and coking coal in the 2014 financial year.

However, even though the volume of coal exports is expected to rise by 2 per cent in 2015, the Bureau of Resources and Energy Economics is forecasting the value of sales to fall by 8.4 per cent because of lower prices.

HSBC's chief economist, Paul Bloxham, says there is a silver lining though.

"It is worth keeping in mind that one of the substitutes for coal is liquefied natural gas, and of course Australia is yet to see that big boost to the economy from production of LNG," he said.

But that means coal's days as Australia's second-biggest resource export could soon be numbered.

Special: The best from Australia

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.