Central bank affirms stable monetary policy in report

The key for China to push down the funding cost for small businesses is to have budget control on some local government borrowings, an expert said Sunday.

The comment was made after China's central bank said Friday that it will keep its monetary policy stable and strive to lower the financing cost to spur the economy.

The central bank will ensure continuity and stability in its monetary policy, the People's Bank of China (PBOC), the central bank, said in a quarterly credit policy report.

Compared with the policy report for the first quarter, the PBOC laid emphasis on "taking multiple measures simultaneously to lower the financing cost in the economy," echoing a recent announcement by the State Council.

A State Council meeting on July 23 chaired by Premier Li Keqiang said that it would launch 10 measures to ease the funding burden for small businesses including reining the unreasonably high lending rates.

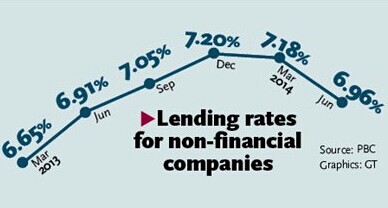

The weighted average lending rate offered to non-financial enterprises and other sectors was 6.96 percent in June, down 0.22 percentage points from March, but the problems of financing difficulties and high funding costs for small firms have become more obvious, according to the central bank.

Small firms' difficulties in securing loans and high costs of credit reflect a structural problem in cascading the central bank's monetary policy, Liu Xiao, a senior analyst at Beijing-based Anbound Consulting, told the Global Times on Sunday.

In the absence of a credit rating system for small businesses, banks often charge a higher rate to small firms when they agree to give loans, he noted.

And banks are reluctant more than ever to grant loans to small and micro-sized firms during the economic slowdown due to the fear of piling up bad debts, analysts said.

By the end of June, the nonperforming loan (NPL) ratio of commercial banks reached 1.08 percent, up 0.08 percentage points from the beginning of this year, with the addition of NPLs worth 102.4 billion yuan ($16.65 billion), the China Banking Regulatory Commission said in July.

The relatively high financing cost is also driven by a high level of corporate debt which pushed up their refinancing needs, demand for large loans by less efficient enterprises which diverted funds that could have gone to smaller firms, and inadequate funding channels from the stock market, according to the PBC.

Because of previous credit expansion, China now has a high corporate debt ratio to its GDP. Chinese corporations owed $14.2 trillion at the end of 2013, which exceeded the outstanding corporate debts of $13.1 trillion in the US, rating agency S&P said in June.

The key to push down the funding cost for small businesses is to have budget control on some local government borrowings which diverted lending resources away from smaller firms, and boost the establishment of privately funded banks and creative financial institutions to cater to the unmet needs, Liu remarked.

China's banking regulator has approved on July 25 the establishment of three new banks wholly funded by private firms including Internet company Tencent Holdings and Zhejiang Huafon Spandex.

The PBC report also showed an increasing concern over rising inflation and faster expansion of credit, therefore the bank might slow down the policy easing in the future, Xu Gao, chief economist of Everbright Securities, wrote in a research note on Sunday.

China's broad money supply M2 grew by 14.7 percent year-on-year by the end of June, up 2.6 percentage points compared to the end of March, indicating abundant liquidity.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.