Low profitability may deter investors

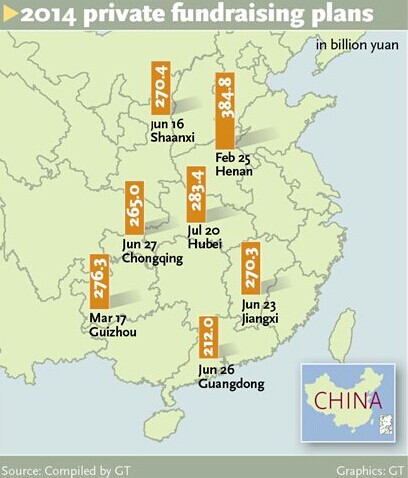

A number of provinces and cities have announced plans to attract private capital in State-dominated sectors following a recent major move by China's State assets supervisor to reform the State-owned enterprises (SOEs) to encourage more private investment in the State sector.

But analysts warned Tuesday only a few private companies would be interested if the government does not provide more incentives.

Central China's Hubei Province said on Sunday that it hoped private capital could enter 95 projects, ranging from infrastructure to new energy sectors, by fully owning the projects, forming joint ventures with SOEs, or running franchises.

Some 283.4 billion yuan ($45.68 billion) will be invested in the projects, most of which are related to transportation infrastructure such as railways and subways, the Hubei Provincial Development and Reform Commission said in a statement on its website.

Before Hubei, several provinces, such as Central China's Henan Province and South China's Guangdong Province, had announced similar plans seeking tens of billions of yuan worth private investments.

China's central government has been pushing to reform the country's often inefficient and corruption-plagued SOEs by introducing more competition from the private sector, hoping the move would accelerate the economic restructuring and combat a slowing economy.

On July 15, the State-owned Assets Supervision and Administration Commission announced that six SOEs will join a pilot program aimed at reforming their ownership and management.

But experts said that despite the local governments' efforts, very few private companies would be interested in pouring cash into infrastructure and social welfare projects.

Liang Jun, a research fellow with the Guangdong Academy of Social Sciences, told the Global Times on Tuesday that private firms usually refrain from investing in infrastructure due to the limited profits.

"Governments always have very tight control over infrastructure charges, such as the subway fares and highway toll fees," Liang said. "That limits the potential for private firms to seek profits, which are their primary consideration in making any investments."

Li Bo, a Shanghai-based analyst with GF Securities, told the Global Times that local governments or major SOEs rarely allow private capital to be injected in their profitable core businesses.

"If governments want private companies to be interested, they need to forsake some of their profits. But it's unlikely they would do so," Li said.

Private companies might be interested in profitable projects such as highway construction and natural gas processing, but less likely to invest in subways and intercity railways, the 21st Central Business Herald newspaper cited an unnamed Hubei government official as saying in a report published on Tuesday.

Hubei is likely to announce more projects solely for private investment, the government statement said, without providing more details.

Local governments usually "subsidize private companies indirectly" to encourage them to invest in unprofitable infrastructure, said Liang. "The authorities may pay private companies cash subsidies after they make their investments. And sometimes governments allow the firms to take the land along the railways or subways they have invested in for free," Liang said.

The National Development and Reform Commission (NDRC) also announced 80 projects in May, in fields ranging from harbor construction to hydropower plants, in which private capital will be encouraged.

Huang Min, an NDRC official, also said in June private companies would provide some 20 percent of the total investment in the 80 projects as of then.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.