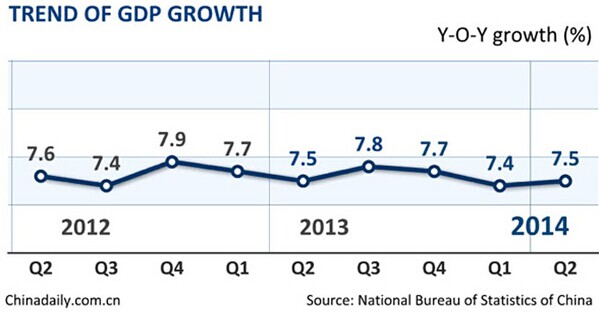

With China recording 7.5 percent GDP growth rate in the second quarter, slightly higher than 7.4 percent it posted in the first quarter, the country has sent a powerful rebuttal to those who worry about rapid economic downturn.

In fact, there have been other positive signs. Purchasing Managers' Index in June was 51.0, a rise of 0.2 compared with that in May and straight increase for four consecutive months. From the beginning of May, "Keqiang index", which measures railway cargo volume, electricity consumption and loans disbursed by banks, began to rise and continued its upward trend in June.

But these positive signs cannot dispel worries of future economic downward pressure. Economic recovery in the second quarter was mainly due to government's "mini-stimulus", not only fiscal policies, but also monetary policies. Fiscal policies focus on increasing investments on affordable housing, transportation and water conservancy construction, transformation of shantytowns and railway infrastructure and monetary policies focus on lowering the deposit reserve ratio of some banks. The data showed that the broad money supply (M2) grew by 14.7 percent, higher than expected.

But these policies are unsustainable. Fiscal policy is mainly about government investment, which can increase debt that is already high. Monetary policy will put pressure on future inflation. These plans mainly have short-term effects, but the government's space for such policies has become increasingly smaller.

Some of the government's "mini-stimuluses", such as cutting tax by replacing sales tax with value added tax, attracting private capital to participate in government projects, reducing various government controls, are also helpful for transformation of economic growth mode. But these policies, which are just minor adjustments of the current institutional system, are difficult to play a visible effect in the short run.

The growth rate of 7.4 percent for the first half year consists of contribution of 0.3 percent from primary industry, 3.5 percent from secondary industry and 3.6 percent from tertiary industry. Compared with the first half of last year, contribution is 0.1 percent higher from primary industry, 0.2 percent lower from secondary industry and 0.1 percent lower from tertiary industry.

So contributions both from secondary and tertiary industry dropped and the decline in secondary industry is particularly noteworthy, since the drop occurred under the background of government's intensive micro-stimulations.

With government investment still playing a key role, the targeted full-year growth rate of 7.5 percent is still attainable. But why does China need to keep such a high economic growth rate.

The answer lies in employment. For 2014, China government needs to stabilize the current employment levels and keep the unemployment rate lower than 4.6 percent. At the same time the government needs to provide 10 million new jobs, which is nearly the entire population of Greek.

In the first half of this year, China actually provided more than 700 million new jobs. It seems that the employment pressure is relatively small for the second half year. But since many new jobs are provided by government projects, the worry still persists that there are not enough new government projects and these projects may result in a large number of unemployed people when they end.

While the government may need the traditional way of stimulation from government investments and micro scale and the micro-stimulations can delay outbreak of possible crises and save time for the transformation of the economic growth model, the final solution is dependent on the recovery of the private economy.

The 3rd Plenary Session of the 18th Central Committee has proposed to allow the market to play a decisive role. Obviously, besides micro-stimulations, the most urgent step is to redefine the boundaries of government and the market, i.e. to transfer the investment-oriented government into a service-oriented one.

The author Wu Jiangang is a lecturer at the Management School of the Shanghai University and a research fellow at the China Europe International Business School Lujiazui International Finance Research Center.

China‘s GDP grows 7.4 pct in H1

2014-07-16GDP growth of 7.5% in range, premier Li says

2014-07-18China‘s GDP growth quickens to 7.5 pct in Q2

2014-07-16Premier Li stresses quality growth, innovation

2014-07-18China‘s growth shows more signs of stabilizing: economists

2014-07-17China‘s H1 growth up 7.4%, showing economic resilience

2014-07-17Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.