Graphics: GT

Big Four banks ranked highest in profitability

China's State-owned enterprises (SOEs) top the country's top 500 list in terms of revenue, while the Big Four banks are ranked highest in terms of profit, the Fortune China magazine showed on Monday.

Private firms have higher productivity in terms of return on equity (ROE), the magazine also said.

Fortune China 500 list 2014, the fifth annual ranking since 2010, covers Chinese firms listed at home and overseas. The threshold for companies to make into this year's list was 8.23 billion yuan ($1.34 billion) of revenue, an increase of 13 percent from the list of 2013.

Revenues of the top 500 total more than half of China's GDP to 28.9 trillion yuan, growing 10.4 percent year-on-year, Zhang Maiwen, editor-in-chief of Fortune China, wrote in a blog on Monday.

Profits of the listed companies increased 13.5 percent year-on-year, significantly higher than the 3 percent recorded in 2013 list, indicating a robust economy, according to Zhang.

However, the SOEs continue to dominate ranking in terms of revenue and profit.

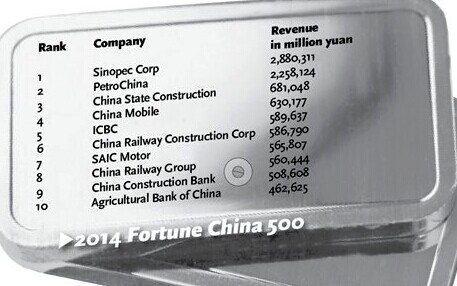

Sinopec, PetroChina and China State Construction Engineering Corp top the list of 2014 in terms of revenue.

Financial institutions led by the Big Four State-owned banks are unsurprisingly the most profitable firms as the list shows.

A total of 29 financial institutions on the list reported a combined profit of 1.27 trillion yuan, equal to more than half of the profits of the top 500 companies.

A total of 36 companies are newcomers to the top 500 list, including e-commerce retailer JD.com Inc which is ranked at No.79 and online discount retailer Vipshop, which is ranked 421st.

Companies falling out of the list include sportswear maker ANTA Sports Products Ltd and fashion retailer Metersbonwe.

Based on the ROE, a key measurement of a corporation's profitability, China's private firms are small but strong, the magazine quoted Li Wei, a professor at Cheung Kong Graduate School of Business, as saying on its website.

Majority of the top 20 firms having the highest ROE ratios are private companies, according to Monday's list.

"China's economy is facing the pressure of restructuring. If the State monopoly sectors give private firms the same access as SOEs, these sectors' productivity will greatly improve, and big and strong multinational Chinese companies might be seen on the list in the future," Li wrote.

"More private companies and mixed-ownership firms are expected to make into the list in the future given the Chinese government's endeavor to cut red tape and increase the role of the market," Wang Hanwu, chairman of the China Brand Management Research Center, told the Global Times Monday.

SOEs post 6.9 pct profit increase

2014-06-20Audit shows mismanagement at SOEs, 190 punished

2014-06-20Regulator cuts profit growth target for SOEs to 5 pct

2014-05-27Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.