Engineers at the JAC factory in Hefei, Anhui. The Chinese auto industry faces a market growing at 6.3 percent compared to more than 25 percent before 2010. LIU QINLI/CHINA DAILY

Nielsen study charts future growth map for companies

As China's economy enters an era of low growth, the backbone automobile industry will face the new challenges after several years of surging market demand.

In a study based on a nationwide survey of more than 1,000 auto consumers in 10 cities in China, industry data and analysis company Nielsen in partnership with the China Association of Automobile Manufacturers identified key challenges posed by the evolving needs of China's consumers.

"The Chinese automobile industry is seeing a compound annual growth rate of only 6.3 percent today compared to more than 25 percent before 2010," said Dong Yang, executive vice-chairman and secretary general of CAAM.

"Daunting challenges exist for all automobile manufacturers trying to maintain healthy growth in a more competitive market.

"Instead of targeting volume sales, auto manufacturers should think about achieving profitable sustainability from both a product and marketing perspective, building category leadership by offering the right products to the right consumers through the right channels."

Changing tastes

Though sedans are still the most important vehicle among Chinese consumers, owned by 54 percent of surveyed respondents, sports utility vehicles loom large in the coming years.

According to the Nielsen study, more than half of potential Chinese car buyers surveyed plan to purchase a SUV, compared with only 20 percent among today's car owners.

SUVs priced between 180,000 yuan ($29,508) and 300,000 yuan were favored by 45 percent of consumers, followed by those with a budget between 300,000 and 500,000 yuan.

Multi-purpose vehicles - more widely known as vans - and coupes are also expected to grow in market share, according to the joint report.

Though their share is now very small - 2 percent for MPVs and 1 percent for coupes - they have increasing purchase sentiment among Chinese consumers surveyed. Each is projected to grow to 6 percent of the market.

Coupes in particular are favored by 52 percent of consumers whose car purchase budget goes beyond 300,000 yuan.

"Instead of only viewing a car as a tool for daily commuting, today's Chinese consumers are more sophisticated," said Alice Yu, vice-president of auto consumer research of Nielsen China.

"From a product perspective, we see stronger demand for middle and high-end SUVs and MPVs priced beyond 180,000 yuan, with most potential buyers coming from the current sedan and small SUV owners.

"The desire for a coupe is mostly from those with a budget beyond 300,000 yuan, so when developing coupe, it needs to be high-end in order to win the hearts of those who are aspiring for a lifestyle of speed and fashion," Yu explained.

Tech innovation

The joint study by CAAM and Nielsen revealed a welcoming attitude toward intelligent vehicle systems as nearly 40 percent of Chinese consumers aspire to own a "connected car".

Among the 42 percent of those who have telematics in their vehicle, a rear-view camera, large touch screen, online news and Bluetooth connection are all frequently used functions.

"Besides the traditional telematics, we see a growing need from automotive consumers for Internet-based functions including online news, music and navigation. Smartphones will play a dynamic role in future connected cars," said Yu.

The survey shows 63 percent of Chinese consumers hope to connect telematics systems with their smartphones.

Increased driving safety, ease of navigation, 3G Wi-Fi hotspot connectivity and voice control are the most desirable smartphone functions for telematics in the vehicle, said respondents

"Given the high and still increasing interest in and aspirations for connected cars among Chinese consumers, manufactures who are putting efforts into the development of vehicle telematics have a better chance to succeed in the big data era," said Dong.

Savvy marketing

In addition to online auto forums and official micro-blogs by brands, WeChat has become one of the most trusted car-related information channels for car buyers thanks to the high number of smartphones across the country.

"The widespread use of smartphones has changed Chinese consumer behavior around car purchases, and likely the payment model for car trades as well," said Yu. "Both smartphone apps and WeChat provide user access to multiple car-purchase platforms that to some extent have further stimulate development of e-commerce in the automobile industry," said Yu.

The study said four out of 10 consumers would consider buying cars online.

"Obviously, the penetration of smartphones has had an impact on consumer behavior. It has become a channel of information and a tool for online payment," said Yu.

But manufacturer websites remain the most trusted channel for information, followed by professional automotive sites, dealer websites and e-commerce sites, said the study.

"One-stop services" remain the most expected services among Chinese consumers for an online car purchase, but "compared with the e-commerce business model for ordinary fast consumer products, automobile products involve a more complicated process with a hybrid of different stakeholders within the market", said Yu.

"It brings challenges but also opportunities for automobile companies to take a more innovative strategy by leveraging the advantages of third parties."

Brand reputation

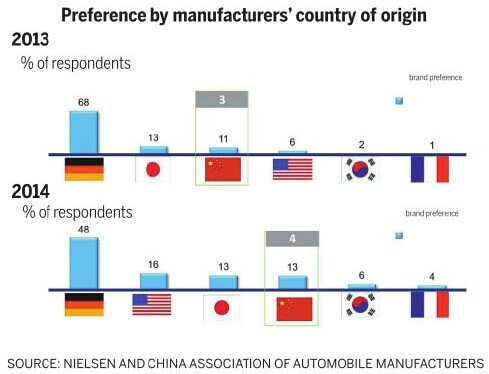

According to the study, German brands were preferred by 48 percent of respondents, followed by American and Japanese brands. The preference for Chinese brands increased 2 percentage points from 11 percent in 2013 to 13 percent this year.

"Consumer attitudes toward the country origin indicate a growing challenge worth the attention of Chinese homegrown brands," said Yu.

The gap between Chinese and foreign brands is also reflected among respondents' opinions on dealer services, marketing communication, competitive position and image.

"The building of a successful brand relies on different factors, not only about product quality, safety and advanced technology, but also other touch points for a brand.

To innovate, Chinese brands need to improve the consumer experience at each touch point from product development to dealer showrooms and advertising effectiveness," said Dong.

Luxury car sales keep foot on accelerator

2014-07-14Electric-car buyers to get tax exemption

2014-07-10Going slow as China car sales cool in June

2014-07-10China‘s car output, sales top 11 million units

2014-07-09Auto Expo reveals close competition in Chinese market

2014-07-13Auto sales up 8.4 percent in H1

2014-07-10Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.