Bold, innovative steps needed to tackle energy challenges, says Sinopec chief

Fu Chengyu, chairman of Asia's largest petroleum refiner China Petroleum and Chemical Corp or Sinopec Group, is not some one who walks away from a challenge, but rather relishes it. The bold, often innovative, moves spearheaded by the 63-year old Fu have not only won him laurels, both at home and abroad, but also provided valuable direction for the growth of the energy industry in China.

Fu's testimony does speak volumes, and stands out for the key role he has played in the transformation of Sinopec and China National Offshore Oil Corp or CNOOC as global energy giants.

"If you look at all the entrepreneurs in China, there are less than five who are in the same league as Fu, especially in terms of the deep and accurate understanding of international capital markets and practical experience," said Qu Jian, an independent energy analyst who has been covering the sector for more than 20 years. Fu is "extremely smart and very business savvy", said Qu.

Fu's tryst with the energy sector began at a very early stage. Born in Heilongjiang province in 1951, Fu graduated from China's Northeast Petroleum Institute majoring in geology. Subsequently, he received his master's degree in petroleum engineering from the University of Southern California.

After his academic career, Fu joined CNOOC, China's largest offshore oil and gas producer, in 1982. For the next 20 years, he worked in a variety of roles with the company before taking over as president and chairman of CNOOC in October 2003, a post that he held till September 2010.

In 2011, he was appointed chairman of Sinopec, China's largest oil refiner and the second-biggest oil and gas producer, which was seen as a promotion. Although it takes only five minutes for Fu to reach his Sinopec office in Beijing from the adjacent CNOOC building, the two companies have a huge gap in revenue and business size.

Last year, Sinopec's total revenue was 2.88 trillion yuan ($464 billion), while CNOOC achieved revenue of 285.85 billion yuan, according to the annual reports.

"A company is always stamped with its leader's personal style," said Qu. "CNOOC is highly internationalized since the company had to cooperate with foreign companies at an early stage of its development due to the lack of technology in offshore oil exploration."

Having executives like Fu who are truly international in approach and style at the top made the real difference for companies like CNOOC and Sinopec, Qu said. Fu speaks English fluently, and is well aware of the nuances and details involved with foreign collaborations, especially in overseas markets.

The London-based Energy Intelligence Group, a market research company focused on the global energy sector, named Fu Petroleum Executive of the Year in 2012. Fu was the first Chinese executive to be given the honor in 15 years, and was lauded for his pioneering role in outbound acquisitions.

After taking over as chairman of Sinopec in 2011, Fu has applied his extensive experience in overseas mergers and acquisitions to revamp the overseas strategy of the company. Of the 11 overseas oil and gas M& As undertaken by Chinese companies in 2011, Sinopec conducted five.

The deals included the $5.1 billion acquisition of Brazilian deep-water assets from Portuguese company GALP Energia, making it the largest Chinese overseas oil and gas acquisition for that year. In 2012, Sinopec acquired one-third of Devon Energy Corp's stake in five shale plays in the US and also decided to acquire a 49 percent stake in US-based Talisman Energy Inc's UK subsidiary.

Ivan Sandrea, president of Energy Intelligence, terms Fu a "transformational figure" in China's oil industry and emerging markets. "By effectively harnessing the nation's strong technical skills, he has been a catalyst in the globalization of China's petroleum business," said Sandrea.

"The international oil market is open to all and we invest in it for profits," said Fu after receiving the award, adding that China's investments in the overseas oil markets have helped bolster global oil supplies. Last year, Sinopec continued its overseas expansion by completing three acquisitions in the US, Russia and Egypt.

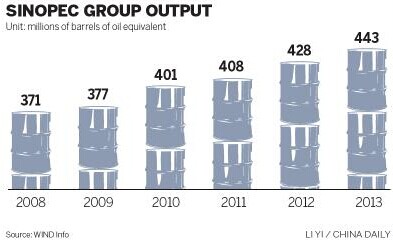

Hou Hongbin, chief geologist of Sinopec, said though the company is still vulnerable in the upstream sector, it has been in a rapid development phase since 2011.

Though Sinopec has made several M& A strides, Fu's most impressive move in the international oil market was the unsuccessful deal with US-based Unocal Corp in 2005 when he was with CNOOC. It was one of China's earliest bids in the oil industry at a time when even the government officials were not convinced of the move. CNOOC had said in 2005 it planned to buy Unocal for $18.5 billion, but the deal could not be completed due to strong opposition from the US government.

"Fu made both domestic and overseas oil industry realize the value of CNOOC with its bid for Unocal," said Han Xiaoping, chief information officer of China Energy Net Consulting Co Ltd.

Han said Fu's "go west" strategy, propelled by the Unocal move, laid the foundation for CNOOC's successful acquisition of Canadian energy giant Nexen Inc in 2013.

"The one thing that stands out about Fu is his innovative spirit. He is someone who keeps his cards to himself and his actions are often unpredictable," said Han.

The biggest development for the energy sector in China this year was the news that government plans to end the State-owned companies' domination of the industry by allowing more private participation.

In February, Sinopec said it was planning to sell up to 30 percent of its retail businesses to private investors, a move hailed by industry experts. This and several other forward-looking measures adopted by Fu have made him one of the key persons driving the industry fortunes in China.

"Selling the retail unit is the first step in Sinopec's planned reforms. We have an integrated and comprehensive plan for further reforms," said Fu. "We want to make the board fully market-based," he said.

Dispelling doubts on whether private investors would gain equal rights in decision-making after they are part of Sinopec's retail business, Fu said reforms are not just gestures, but concrete steps to protect the interests of all shareholders.

Han said that Sinopec's reform measures are sensible as it is not profitable for the company to operate service stations in the long run. "The retail unit can bring significant profits and it is innovative and beneficial to bring in more participants," said Han.

"Fu likes challenges and he has brought a whiff of fresh air (new thinking) to Sinopec, something that is a rarity in a State-owned company," he said.

CNOOC, private firm ink gas station deal

2014-06-24CNOOC, BP sign 20-year LNG supply deal

2014-06-18CNOOC Kenli oilfields start production

2014-05-14CNOOC eyes private capital for expansion

2014-04-04CNOOC releases 2013 sustainability report

2014-04-01CNOOC produces 66.84 mln tons of crude oil

2014-04-01Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.