PMI rebound reflects impact of SME support measures: economist

A preliminary HSBC survey has shown that activity in China's manufacturing sector expanded in June for the first time in six months, reinforcing sentiments that the economic recovery is stabilizing as a result of the government's mini-stimulus.

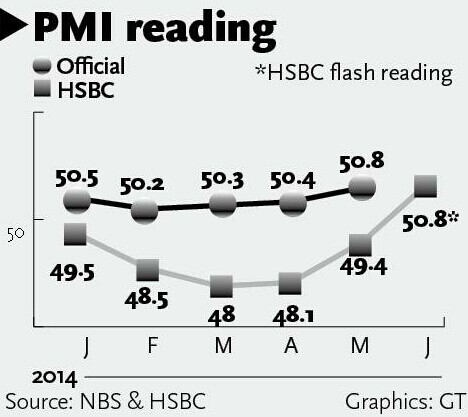

The flash reading of China's manufacturing Purchasing Managers' Index (PMI) rose to 50.8 in June from a final reading of 49.4 in May, HSBC Holdings PLC said in a report issued Monday, beating a market forecast of 49.7.

A PMI reading above 50 indicates growth, while a reading below that figure indicates contraction. The June reading was the highest since November 2013.

Analysts, however, still expect more fine-tuning steps to be rolled out in the following months to maintain steadier economic growth.

"This month's improvement is consistent with data suggesting that the authorities' mini-stimulus is filtering through to the real economy," said Qu Hongbin, chief economist for China at HSBC.

Qu's opinion was echoed by Zhang Lei, a macroeconomic analyst with Minsheng Securities.

Zhang told the Global Times Monday that the rebound in PMI reflects the impact of government policy support measures for small and medium-sized enterprises (SMEs) in recent months.

For instance, the government has extended tax breaks. In April, the State Administration of Taxation announced that any enterprise with annual taxable income below 100,000 yuan ($16,010) would have their business income tax halved from January 1 this year to the end of 2016. The previous threshold was 60,000 yuan.

A sub-index, manufacturing output, rose to 51.8 in June, also the highest in seven months and up from May's 49.8.

"The HSBC readings confirm our views that stable economic recovery will continue throughout the second quarter," said Zhang.

According to a research note Bank of America-Merrill Lynch e-mailed to the Global Times, the preliminary reading in June indicates that sequential growth will increase to 1.8 percent in the second quarter from 1.4 percent in the first quarter, and that GDP growth in the second quarter is expected to increase to 7.5 percent.

Qu believes that infrastructure investments and related sectors will keep on supporting the recovery in the next few months.

Premier Li Keqiang vowed last Wednesday that China's economy would not have a hard landing.

To maintain stable growth, the government is expected to continue issuing more measures, Lu Ting, an economist at Bank of America-Merrill Lynch, said in the research note.

And it is time for the government to launch some measures to offset the risks from the property downturn, Zhang remarked.

Among other sub-indices offered by HSBC, overall new orders, a reading to measure foreign and domestic demand, grew sharply, while growth in new export orders slowed slightly, indicating that the rise was mainly driven by domestic consumption.

Zhang said that companies, especially export-oriented ones, are reluctant to sign long-term orders due to the continuous appreciation of the yuan.

Data from the General Administration of Customs showed that in the first five months of 2014, China's exports reached 5.4 trillion yuan, a 2.7 percent drop year-on-year.

Although companies have seen orders increase, they are still struggling to make ends meet, said Chen Naixing, head of the SME Research Center of the Chinese Academy of Social Sciences.

"Their profit margins are narrowing due to rising labor costs as a result of labor shortages," said Chen.

Zhang thinks that the government could continue reducing taxes and administrative fees to ease their burden.

But Chen held a different attitude, expecting no incremental financial support measures for enterprises from the government; otherwise they will be "lazy when it comes to upgrading their production lines."

The final results of the HSBC PMI survey for June will be released on July 1 and those of a separate government-sponsored manufacturing PMI will be published on the same date.

The official PMI reading is usually stronger than the HSBC PMI as the official survey is more focused on large, State-owned firms and the latter on smaller, export-oriented firms.

Stock markets close down despite upbeat PMI data

2014-06-24China‘s non-manufacturing PMI rises in May

2014-06-04Service PMI posts best record in 6 months

2014-06-04HSBC PMI shows economy is stabilizing

2014-06-03China‘s non-manufacturing PMI rises in May

2014-06-03China‘s PMI hits 5-month high, pointing to stabilizing economy

2014-06-02China‘s PMI rises to highest level in 2014

2014-06-01Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.