German companies operating in China are performing robustly and remain relatively optimistic despite the country's economic slowdown, a survey published by the German Chamber of Commerce in China showed Thursday.

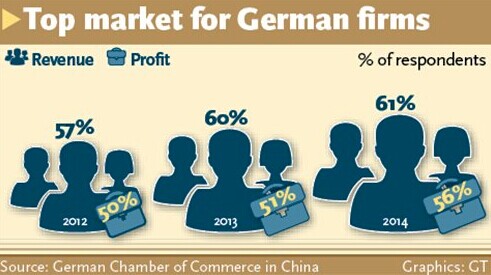

Around 61 percent of surveyed companies see China as the top market for their German parent company in terms of turnover, and 56 percent of respondents see China as the top market for their German parent company in terms of profit, slightly higher than last year's figures, according to the Business Confidence Survey 2014 of the chamber's 417 member companies conducted between May 12 and June 6.

While growth rates for early entrants that have been operating in China for more than a decade are moderate, the Chinese market still offers opportunities for rapid growth to newcomers that have been in China for less than two years, the survey said.

About 45 percent of companies plan to increase their investment in the future, similar to the finding of previous survey conducted in 2013. However, companies are becoming more cautious about expanding too rapidly, and are instead more likely to focus on the consolidation of investments at existing operation sites, according to the survey.

In terms of investment destination, Southwest China's Chengdu and Chongqing are mostly likely to become the next German business hubs, while the central and northeastern regions seem to be less attractive.

German companies are more confident than their other European counterparts. In a separate survey released by the European Union Chamber of Commerce in China in late May, half of European companies believed that the "golden age" for multinational companies in China is over, citing China's economic slowdown, rising labor costs and market access barriers. Only 57 percent of respondents plan to expand their current China operations, down from 86 percent last year.

"German companies' advantages lie in high-end manufacturing, which is what China urgently needs during the country's industrial upgrade," Bai Ming, a research fellow with the Chinese Academy of International Trade and Economic Cooperation, told the Global Times Thursday. "That's why their businesses have been less affected by the country's economic slowdown."

US firms are also increasingly cautious about future investments in China as growth in revenue and profitability slows in the market, according to a survey released in March by the American Chamber of Commerce in China.

Foreign investment into China has shown signs of slowdown amid multinationals' weakening sentiment. The country took in $8.6 billion in foreign direct investment (FDI) in May, a drop of 6.7 percent from a year earlier, data from the Ministry of Commerce showed Tuesday.

China's slowdown, structural adjustment, poor policy implementation and previous depreciation expectations of the yuan all contributed to the slowdown of FDI inflows, according to Bai.

German companies perceive reforms initiated by the central government as generally positive, but the effect of the reforms on future investments remains to be seen, the survey said.

For instance, detailed measures in the China (Shanghai) Pilot Free Trade Zone are yet to be announced, so many foreign companies have to take a wait-and-see attitude amid policy uncertainties, said Bai.

In the survey, 48.6 percent of the surveyed firms said the new policies will have no impact on their investment decisions.

As for the mixed-ownership structure trial, so far no details are available regarding which fields and to what extent could foreign firms participate, and that's why they are cautious about the effect of the reforms, Feng Pengcheng, a professor at the University of International Business and Economics in Beijing, told the Global Times Thursday.

At a media briefing to release the result of the survey, German Ambassador to China Michael Clauss said Germany and China aim to establish an offshore yuan center in Frankfurt, and both sides are in the process of choosing a clearing bank.

"Once the bank is selected, the yuan business will be soon put into operation, which will benefit trade and investment among China, Germany and other EU economies," Clauss said.

China's central bank said late Thursday that it has authorized the Frankfurt branch of Bank of China (BOC) to be the clearing bank for yuan business in Frankfurt. Earlier on Wednesday, it selected China Construction Bank to be the yuan clearing bank in London.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.