China announced a slew of measures on Thursday to boost the country's sluggish film industry with more capital and financing channels for movie makers.

Several ministries, including the Ministry of Finance (MOF) and the National Development and Reform Commission, said they would spend 100 million yuan ($16.01 million) each year to support five to 10 films with "important themes," provide capital to develop animation technology and encourage financial institutions to lend cash to filmmakers.

Shares of filmmaking companies have been soaring since late May, when the statement was dated. Huayi Brothers Media Corp, one of China's biggest private media and entertainment conglomerates, surged by 13.6 percent from May 30 to 23.97 yuan per share on Thursday. Hong Kong-listed Orange Sky Golden Harvest Entertainment Holdings Limited jumped by 15.7 percent from the end of May to Thursday.

Chen Shan, a professor from the Beijing Film Academy, told the Global Times on Thursday that the news will significantly benefit Chinese movie makers and the film industry.

"Chinese filmmakers are short on funding. The fact that the central government would step up to solve that problem is very exciting," Chen said.

Hou Tao, vice president of entertainment consultancy Entgroup, told the Global Times Thursday that the announcement will allow Chinese filmmakers to bridge the gap between domestic and Hollywood movies, by offering them more cash to produce films with advanced technology.

According to the statement, China will use its cultural development fund for purposes including facilitating the use of animation technology in filmmaking, supporting movies to be distributed abroad and building film-related websites.

Also, sales of film copies, copyrights, distribution, and revenues from showing films in China's rural areas will be exempted from value-added tax (VAT) from January 1, 2014 to the end of 2018.

"Reducing the VAT burden on film production companies could spur innovation and encourage more artists to make good movies," Chen said.

The statement was released as China's media companies are enjoying booming development thanks to the government's support and the public's growing demand for cultural products.

Since earlier this year, Chinese companies have been making moves to benefit from the burgeoning industry. The video streaming arm of Internet service giant Tencent Holdings announced on Tuesday that it would start investing in movies, and e-commerce giant Alibaba Group launched an online fund on March 26 to provide capital for film and TV show makers.

The Chinese government also encouraged financial institutions, including banks and funds, to innovate on credit products, expand financing channels to film companies and widen the range of collaterals that firms can use to get loans. The country will develop financing services that do not require tangible collateral.

Bai Haibin, a Beijing-based film director, told the Global Times on Thursday that obtaining financing is very difficult, because of the risky nature of filmmaking.

"Banks are not inclined to lend money to movie makers, who can rarely provide tangible collateral and cannot guarantee the box office of their revenues," he said.

Bai and film producer Li Yan are at the Shanghai International Film Festival to seek financing from film funds for his new film The Love Flower at War, which tells a story about a Chinese boy and a Jewish woman during the World War II.

The ministries also plan to encourage production companies to seek IPOs and issue corporate bonds. The country will provide subsidies to filmmaking bases, companies and projects, the statement said. It would also subsidize the construction of movie theaters in rural areas in less-developed central and western China.

China announces stimulus package for film industry

2014-06-20Internet changes future film industry

2014-06-19Domestic box office spending set to swell

2014-06-14Chinese box office spending will soar 88 pct by 2018

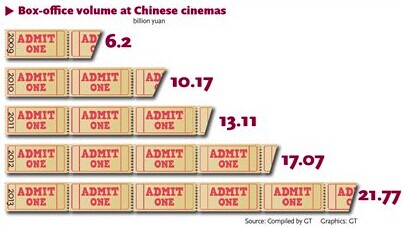

2014-06-12China‘s box office takings surge since 2002

2014-06-06More cinemas suspended for box office fraud

2014-05-26Box office totals 21.8 bln yuan in 2013

2014-01-06Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.