Online fund marks one-year anniversary

Yu'ebao, an online monetary fund operated by top Chinese e-commerce company Alibaba Group, the first of its kind in the country, has attracted over 100 million investors, a company official said on Sunday, a sign of the rocketing popularity of Internet-based fund products that have eclipsed traditional bank deposits.

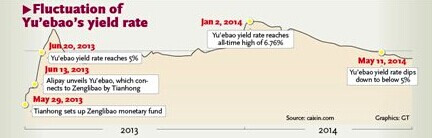

Friday marked the first anniversary of the launch of Yu'ebao, co-created by Alipay, Alibaba's third-party payment system, and Tianhong Asset Management Co. Over the past year since the launch, the fund has gathered more than 100 million investors, Zhang Daosheng, a spokesman for Alipay, told the Global Times on Sunday. He didn't reveal the figures for the amount of money that has been invested in the fund up to now.

The latest publicly available data from the company showed that investment in Yu'ebao reached 541.3 billion yuan ($87.99 billion) by the end of March, while its subscribers amounted to 81 million at the end of February.

The soaring growth has not only catapulted previously little-known Tianhong into becoming the largest fund management company in the country, but spurred the offerings of more online funds from other companies.

Companies from different sectors, such as Internet - Baidu Inc and Tencent Holdings, online retailers - suning.com and jd.com, and commercial banks - Ping An Bank Co and Industrial Bank Co, have jumped into the Internet finance arena with alternatives to Yu'ebao, touting proceeds on par with or even higher.

The seven-day annualized yield of Alibaba's Yu'ebao rose to 4.74 percent on Sunday, slightly higher than the previous day's 4.73 percent.

The current proceeds for funds like Yu'ebao have declined from highs of nearly 7 percent seen at the beginning of the year, but the Internet-based funds remain attractive especially for regular individual investors for whom the funds are an ideal mix of high liquidity and attractive rewards, analysts said.

Expressing his bullish sentiment toward the future of the online finance sector, Feng Lin, a senior analyst at Hangzhou-based China E-Commerce Research Center, told the Global Times on Sunday that the banking sector has already felt pressure from these rapidly growing Internet-based monetary funds, although such funds actually act as an intermediary pumping money into the inter-bank lending market.

Data from the People's Bank of China (PBC), the country's central bank, showed on Thursday that new yuan-denominated deposits in May were 1.37 trillion yuan, 110.8 billion yuan less than the same period last year.

Meanwhile, Feng said that the Internet finance market, especially the segment of online peer-to-peer lending, features heightened exposure to risks compared to the traditional banking sector, which has increased regulators' alertness against the eruption of potential defaults .

In the latest sign of the government's concern over security of Internet finance, the PBC said in its annual report released on Wednesday that an effective regulation of online finance is still absent from the current legal framework and operational risks might emerge as a result of an incomplete risk control regime.

Media reports have rumored that money market funds such as Yu'ebao might be subject to reserve requirements as the central bank raises the security bar for the online finance market.

But Zhang at Alipay said that there are no grounds for the application of reserve requirements, as the money put into the funds are not the same as bank deposits.

Saying that the lowered proceeds won't dent customer sentiment on Yu'ebao, which offers a lot of value-added services, Zhang disclosed more partnerships are being considered as the company plans to add to its online fund arsenal.

Tianhong is set to become part of Alibaba, which has been expanding ambitiously, following the China Securities Regulatory Commission's approval in May of Alipay's taking control of Tianhong with a 51 percent stake purchase.

Still some hold less upbeat views concerning the future of Internet finance in China.

The rapid growth of Internet finance is a reflection that the country has made headway in developing a market-oriented financial sector, Xu Bo, an analyst at Bank of Communications in Shanghai, told the Global Times.

But with interest rates expected to be fully liberalized in the foreseeable future, the Internet finance market may lose traction as banks would finally be freed from the current regulatory retractions on setting deposit rates, said Xu.

Online fund yields still falling

2014-05-05Tencent becomes the latest online platform to launch fund product

2014-01-17PBOC steps up drafting Internet finance guideline

2014-04-11Concern raised over Internet finance

2014-04-10Internet finance shaking up Chinese banks

2014-04-03Internet finance to boost economy

2014-03-07Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.