While the number of credit cards keeps growing in China, overdue payments and non-performing loan ratios for credit cards also are soaring, Beijing-based Web portal NetEase said in a report published on Thursday.

Statistics from the People's Bank of China, the central bank, showed that credit-card debt at least six months overdue rose to 25.19 billion yuan ($4 billion) at the end of 2013, up 71.86 percent from the previous year.

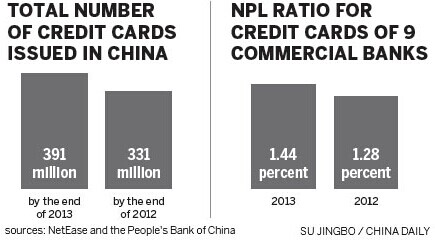

The average credit card NPL ratio of nine selected commercial banks reached 1.44 percent in 2013, rising 0.16 percentage points over 2012's figure. It was also higher than the average NPL ratio of 1 percent for commercial banks reported at the end of December.

According to an online survey conducted by NetEase with 30,365 credit card users in April and May, about 16 percent of them had experienced poor credit scores in the past two years because of overdue payments. Nearly 30 percent of

the users reported only being able to make minimum payments. About 21 percent of the users said they had taken out a cash advance on their credit card.

The increase in bad credit-card debt has caused the credit card industry to deliberate on how to ensure the industry develops in a healthy way during its skyrocketing growth.

Financial analysts said some consumers cannot help overspending with their credits cards, which has led to the rise in non-performing loans.

PBOC figures revealed that the number of credit cards issued nationwide hit 391 million by the end of 2013, up 18 percent from 2012.

The NetEase survey found that nearly 80 percent of the users have at most three credit cards, and 32 percent of that group have only one card.

Almost half the people surveyed said they typically use just one credit card, and about 20 percent reported that their card issued by China Merchants Bank Co Ltd is the one they most commonly use.

Nearly half the people surveyed listed credit limit as the most important factor governing card usage. The other two main factors were convenience of repayment (43 percent) and special offers by the card company (29 percent).

Almost 40 percent of the respondents said they have a credit card limit between 10,000 yuan and 30,000 yuan, the report said.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.