Activity in China's factory sector rose to a five-month high in May, official data showed on Sunday, raising hopes of stabilization in the economy despite worries about a cooling property sector.

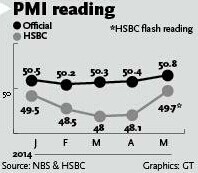

The official Purchasing Managers Index (PMI), mainly capturing larger and State-owned enterprises, increased by 0.4 percentage points from the previous month to 50.8 in May. This third successive pickup in a row was pulled up by a rebound in both new orders and new export orders, the proxies for domestic demand and foreign demand respectively, according to a statement posted on the website of the National Bureau of Statistics (NBS) on Sunday.

A reading above the 50-point mark points to expansion in manufacturing, while an index below tells of contraction.

The continued rebound seen in the forward-looking PMI provides more evidence of a stabilizing economy, Zhang Lei, a macroeconomic analyst with Minsheng Securities, told the Global Times on Monday.

A breakdown of the official survey results also showed a broad-based stabilization in the economy during May. Of the 11 sub-indices of the PMI reading, all but the components measuring stocks of raw materials, employment and stocks of finished goods rose in May compared to a month earlier.

A preliminary survey by HSBC which focuses on smaller and private enterprises also buttressed a pickup in factory activity. The HSBC Flash China PMI announced on May 22 a recovery to 49.7 in May from the previous month's final reading of 48.1. The final reading for May is scheduled to be published on Tuesday.

The strong PMI reading for May is "a welcome sign that the targeted approach to stimulus, adopted by the current government, appears to be bearing fruit," Julian Evans-Pritchard, China economist at Capital Economics said in a research note sent to the Global Times on Monday.

In the latest of a series of targeted, mini stimulus measures aimed to put a floor under growth of the Chinese economy that slowed to an 18-month low of 7.4 percent in the first quarter, Premier Li Keqiang announced last week that the country will cut the reserve requirement ratio (RRR) for those banks meeting certain ratios of lending to the rural sector and small- and micro-sized enterprises in an expansion of targeted RRR cuts.

The central government is expected to step up targeted measures to prop up economic growth, as "there are still strong headwinds due to the downturn of the property sector and the anti-corruption campaign," Bank of America Merrill Lynch economists led by Lu Ting, said in a research report sent to the Global Times.

But universal measures such as cutting benchmark rates and cutting RRR for all banks will not be considered, the economists believe.

By pledging to allow the market to play a decisive role in the economy, the government will not continue to massively intervene in the economy, Zhang remarked, brushing aside possibilities of any universal stimulus.

He told the Global Times that China's service sector has shown strong growth momentum in recent years and is on course to become a new growth engine to offset the drag on the overall economy from the property sector.

"The apparent stabilization in the manufacturing sector should give policymakers more leeway to work toward their goal of rebalancing growth by allowing other sectors, such as real estate, to cool further," Evans-Pritchard said.

China‘s non-manufacturing PMI rises in May

2014-06-03China‘s PMI hits 5-month high, pointing to stabilizing economy

2014-06-02China‘s PMI rises to highest level in 2014

2014-06-01Improved PMI data props up copper futures

2014-05-26HSBC flash PMI at five-month high

2014-05-23China‘s PMI at five-month high

2014-05-23HSBC Flash China PMI at five-month high

2014-05-22Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.