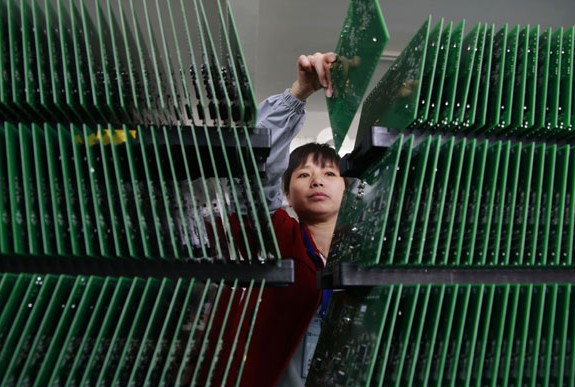

A worker with the Jiangxi-based high-tech company Shanshui Electronics Co Ltd sorts circuit boards. Tens of thousands of private equity and venture capital firms are believed to be behind China's vibrant technology, media and telecommunication sector. ZHANG HAIYAN/CHINA DAILY

Gong Yan, assistant professor of entrepreneurship at the China Europe International Business School, shows passion when he talks about Tesla Motors Inc.

For him, the California-based company represents a "disruptive innovation" that few Chinese companies have achieved.

Tesla, he says, is to the vehicle industry what Apple Inc has been for the mobile phone industry. It's tossed out what people think of as being a car.

Its "disruptive innovation" is reflected mainly in its product and business model. Tesla produces battery-powered electric cars. It provides car owners with a free battery-charging service through a nationwide network of solar-powered charging stations.

Unlike buyers of conventional cars that rely on massive dealer networks, Tesla consumers can go to its direct sales stores for test drives, place orders online and enjoy cloud-based after-sale service.

Chinese electric car companies don't lag too far behind Tesla in terms of technology, Gong said. On the contrary, a few companies such as Shenzhen-based BYD Auto Co Ltd have developed an edge in some electric car-related technologies. What they lack, according to Gong, is a "revolutionary" aspect to their products and the will to pursue an "extreme" consumer experience.

Companies do not necessarily have to be "revolutionary" to be successful. Most companies succeed as they follow well-established paths and improve their products incrementally. In this regard, Gong said it's "not fair" to compare BYD and Tesla because they are totally different companies.

"It is difficult to compare Tesla with any other company because it is really disruptive, in its business model and product," he said.

That doesn't mean Chinese companies haven't got a chance. Chinese enterprises are rapidly catching up with their Western competitors in many fields. Contrary to popular perception, there is little difference in the mobile Internet field, said Gong, who completed a doctoral degree in the United States and taught at the University of California, Irvine before joining CEIBS.

"The mobile Internet industry in China is so developed that I believe it could soon export some innovation to the rest of the world," Gong said. "So far, Chinese entrepreneurs have excelled at application-oriented fields, such as the mobile Internet and electric cars. But if you look at fields that are more closely related to basic science, such as medicine, there is a huge gap with the US."

Behind China's vibrant technology, media and telecommunication sector, Gong said, are tens of thousands of private equity and venture capital firms, as well as millions of entrepreneurs who aspire to be tomorrow's Elon Musk (chief executive officer of Tesla).

China's VC model is copied from Silicon Valley, so both extensively focus on the TMT sector. That focus has offered a good financing environment for entrepreneurs in that particular sector, but it's a much less friendly environment for other industries, according to Gong.

"In China's TMT sector, the problem is not lack of money but a lack of creative ideas. China's social enterprises face a much tougher environment," he said. "In Silicon Valley, nearly a quarter of the venture capital funds have gone into social enterprises, but here the share is minor.

"If you also consider charitable foundations and crowdfunding in the US, which support social enterprises, the gap is huge."

Another potential risk of VCs' focus on TMT in China is that too many entrepreneurs might be tempted to join this field despite lacking the passion and resources, Gong said.

"So for entrepreneurs, it is important to care about what VCs care about, but not to follow them blindly. You can't dance to the VC firms' beat," he added.

But Gong is no pessimist when it comes to China's entrepreneurship. He said his interaction with domestic entrepreneurs convinced him that the nation's entrepreneurial spirit is high.

Cultural factors are also on China's side, he said, because "no fear of making mistakes", a vital trait for entrepreneurs, is much more prevalent here than in other East Asian nations.

"You look at any entrepreneurship index, and you find China is among the highest in the world. This is a country full of passion for entrepreneurship. I see no sign that the fever is waning. Quite the opposite," he said.

The only factor that may hinder this innovative impulse, according to Gong, is government regulation in many industries. China's most dynamic sectors are also those least regulated, and there's a good reason for that.

Tesla hits bump in road with charging facilities

2014-04-23Chinese automaker looks to overtake Tesla

2014-04-15Smaller, cheaper EVs may trump pricey Tesla

2014-02-28GAC, BYD announce new energy vehicle JV

2014-04-24BYD, BAIC green cars get free plates

2014-02-28BYD ‘green‘ cars get go-ahead for Beijing, Shanghai roads

2014-02-28Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.