An increasing number of cities saw declining property prices in April, with eight cities having seen a drop in new commercial housing prices month-on-month, compared with four in March, data from the National Bureau of Statistics (NBS) showed on Sunday.

Nanjing in East China's Jiangsu Province and Xiamen in East China's Fujian Province reported the highest price growth month-on-month for new commercial housing at 0.4 percent in April, according to the NBS.

In April, second-hand housing prices in 22 out of 70 cities monitored by the NBS dropped month-on-month, compared with falls in 14 cities in March, the NBS data showed.

Around half of the cities monitored by the NBS are expected to see negative month-on-month growth in the next six months, said Yang Hong-xu, vice president of Shanghai-based E-house China R&D Institute.

Wenzhou in East China's Zhejiang Province was the only city to see a year-on-year drop in new commercial housing prices in April.

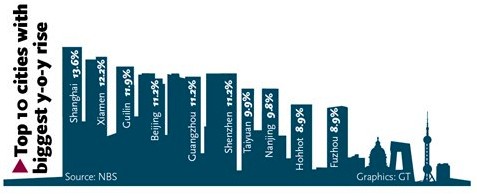

Shanghai's new commercial housing prices rose 13.6 percent year-on-year in April, the highest among the 70 cities, and new commercial housing prices in Beijing rose 11.2 percent year-on-year last month, the data showed.

Most experts believe that China's property sector is cooling.

Liu Shijin, deputy head of the Development Research Center of the State Council, said at a forum in Beijing on Sunday that China's newly added housing demand is expected to reach a peak in 2015, at around 12 to 13 million units, according to a report from news portal sina.com.cn.

"The basic supply-demand relationship [in the real estate market] does not support long-term fast growth in housing prices," Liu noted.

The real estate sector accounts for around 50 percent of the country's total investment, according to Liu, but investment in the real estate sector is also slowing down.

Data from the NBS last week showed that total investment in the real estate sector reached 2.23 trillion yuan ($357.4 billion) in the first four months, up 16.4 percent year-on-year - 0.4 percentage points lower than the growth rate in the first quarter.

The cooling property market has prompted concerns that China's overall economy may slow further.

"We expect the weak property sector to act as a drag on investment and lead to [China's] GDP growth slowing to 7.1 percent in the second quarter," Nomura Securities wrote in a research note sent to the Global Times on May 2.

Liu also said at the forum that a growth rate of around 7 percent will become a normal state for China's economic growth.

However, Chen Guoqiang, deputy head of the China Real Estate Society, noted that the current cooling does not mean that the sector is facing a meltdown. "The real estate sector will enter into a new stage after the country passes the demand peak, and second-hand transactions will account for a major share," Chen said.

Second-hand housing transactions account for over 50 percent in the real estate market in China's first-tier cities, according to Chen, but the rate is around 90 percent in some developed economies.

Several cities such as Nanning and Tianjin have rolled out policies to loosen restrictions on housing purchases. The People's Bank of China, the country's central bank, also demanded last week that commercial banks should set mortgage rates at reasonable levels and speed up approvals of loans for legitimate home buyers.

Yang noted that although the central bank's move will not reverse the current downward trend in the real estate sector, "the price drop will be moderate."

Prepare for pop of property bubble

2014-05-05Property map reveals agony of home buyers

2014-05-19Slump drives property developers to the wall

2014-05-15China‘s property sector cools in April

2014-05-13Investors shunning property for funds

2014-05-13Chinese cities expected to ease property regulations

2014-05-19Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.