![New towers go up in Qingdao, Shandong province. A new survey found that the residential vacancy rate in Chinese cities is higher than that in major US cities.[Photo/China Daily] New towers go up in Qingdao, Shandong province. A new survey found that the residential vacancy rate in Chinese cities is higher than that in major US cities.[Photo/China Daily]](U468P886T1D113601F12DT20140513084857.jpg)

New towers go up in Qingdao, Shandong province. A new survey found that the residential vacancy rate in Chinese cities is higher than that in major US cities.[Photo/China Daily]

CLSA study says number could rise annually by as much as 4m

China has about 10.2 million units of empty housing, and that number could rise by 3 to 4 million a year, according to Credit Lyonnais Securities Asia Ltd.

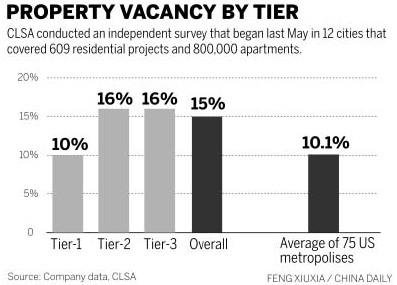

If this estimate is accurate, it means that China's vacancy rate was 15 percent last year, 5 percentage points higher than the average in the United States.

Vacancy rates varied among Chinese cities, CLSA said.

In first-tier cities, which it defined as Beijing and Shanghai, the rate was 10 percent. The rate in second- and third-tier cities as a group was 16 percent.

Ordos, Inner Mongolia - sometimes cited in media reports as a "ghost city" - had the highest vacancy rate of 23 percent.

How many houses are empty is a wild guessing game, because the statistical authorities don't provide figures.

But it's also a crucial number, because the number of vacant homes is directly linked to the extent of oversupply and thus the size of a bubble, if any, in the property market.

Concerns about oversupply increased after an urban building spree in recent years, followed by media reports showing residential communities dark at night.

CLSA's estimate is among the more conservative, with other estimates of vacancy rates ranging from 20 to 30 percent. A study by Peking University in 2013 said an average Chinese family owns 100 square meters of living space, and 10 percent of households own two or more residences.

CLSA's estimate is based on an independent survey it began last May in 12 cities that covered 609 residential projects and 800,000 apartments. The survey team carried out home visits and went to projects to see how many lights were on at night.

It only surveyed units completed from 2007 to 2011 because the survey team felt adding houses completed in 2012 and thereafter might inflate the vacancy rates, because many buyers moved into their new homes one or two years after buying them.

"The result is actually lower than what we had thought, because our experience told us the ratio could be roughly 25 percent," said Nicole Wong, regional head of property research of CLSA. She said vacancy rates in first-tier cities aren't that high, and higher ratios in some second-tier cities aren't a problem either.

In cities such as Zhengzhou and Tianjin, the vacancy rates were 23 and 21 percent respectively, but that could be reduced through massive population inflows.

But the situation in third-tier cities was far more worrisome, the team found. The construction spree of recent years left large inventories, but the population flows to fill those units just aren't there.

For those cities, 2014 will be a turning point, according to CLSA.

Last year, 790 million sq m of housing was sold in third-tier cities. By 2020, that area will shrink as much as 60 percent. But in first- and second-tier cities, sales areas will rise 6 to 12 percent. Overall, sales by 2020 will shrink by 36 percent.

This year "will be a turning point because as of last year, China's housing sales were equivalent to 11.9 percent of GDP. That's excessive, and unsustainable, given that at Hong Kong's property peak, just before its property crash in 1998, the ratio was just above 9 percent," said Wong.

Prepare for pop of property bubble

2014-05-05Property bubble burst foreseen

2013-11-11Real estate bubble seen bursting in China, US: Experts

2013-11-12China‘s housing sector to enter ‘autumn season‘: expert

2014-05-12China accelerates property registration

2014-05-09Property tracking system launched

2014-05-09Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.