China's consumer prices increased at a slower pace in April as the cost of fresh vegetables and pork both declined, official data showed on Friday.

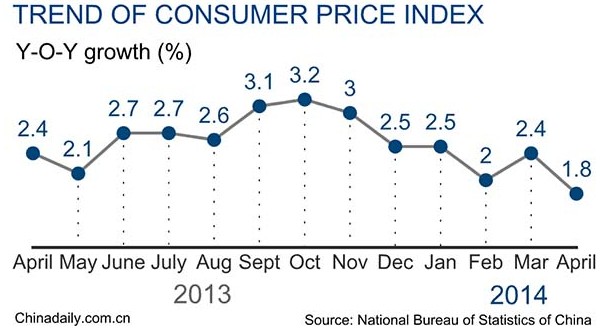

The Consumer Price Index (CPI), a main gauge of inflation, increased 1.8 percent year on year in April, down from 2.4 percent in the previous month, according to the National Bureau of Statistics (NBS).

The lower inflation in addition to high downward pressure on economic growth might lead to a "slight" easing of monetary policy, economists at government think tanks told Xinhua.

Slower increases in food prices were the main contributor to the lower CPI figure. Food prices increased 2.3 percent year on year, down from 4.1 percent in March.

Prices of pork, a staple of the Chinese diet, fell 7.2 percent, dragging down the CPI by 0.21 percentage points. Prices for the whole meat and poultry category dipped 0.7 percent, dragging down the CPI by 0.05 percentage points.

Fresh vegetable prices went down 7.9 percent, pulling down the CPI figure by 0.28 percentage points, the NBS said.

Wang Jun, an economist at the China Center for International Economic Exchanges (CCIEE), a government think tank, attributed the falling pork prices to the "improved relationship between supply and demand".

The fall in vegetable prices was mainly due to lower logistics costs resulting from the government's infrastructure building, Wang added.

The CPI rose 2.2 percent in the first four months from a year earlier, much below the government's 2014 target of about 3.5 percent.

Niu Li, an economist at the State Information Center which is under the National Development and Reform Commission, said the moderate CPI was a "reflection of the weak overall demand and slower economic growth".

The producer price index (PPI), which measures inflation at wholesale level, also contracted 2 percent year on year in April, following a 2.3-percent decline in March.

The lower CPI came as China's economy is showing signs of slowing down. For the January-March period, the economy grew by 7.4 percent, down from 7.7 percent in the fourth quarter of 2013 and marking the lowest quarterly growth level since the third quarter of 2012.

As to speculation that the government may loosen policy to bolster growth, the two economists said the "basic tone" of the monetary policy would remain unchanged, but there might be some fine tuning.

"Given that the monetary policy should be "pegged" to inflation, the current moderate inflation means slightly loosening the policy would not affect the prices," Niu said.

"The monetary policy should be maintained stable but slightly relaxed, because downward pressure exists and there are risks in the housing market, most local government debts are due soon and the elimination of overcapacity would bring about more job losses," Niu added.

"These problems are not going to worsen so long as the economy can grow steadily. But if demand and growth rate both come down, the problems would be more and more serious," Niu said.

Echoing Niu, Wang of the CCIEE called for some fine tuning of the monetary policy.

"The fact that the basic tone of the monetary policy remains unchanged doesn't mean you have to avoid fine tuning," Wang told Xinhua.

"You should move the steering wheel as the situations on the road change," added Wang, expecting more "differentiated" lowering down of the deposit reserve ratio, which means the policy is only applicable to specific industries or sectors.

An overall lowering down of the deposit reserve ratio might also be necessary depending on the economic situation in the second quarter, said Wang.

The central bank vowed to maintain "continuity and stability" of its monetary policy in a report released on Tuesday.

The People's Bank of China will continue to adopt a prudent monetary policy and fine tune it in light of changes so that the policy can stabilize growth, boost reforms, adjust structures, enhance people's welfare and prevent risks, said the report.

China‘s CPI up 1.8 percent in April

2014-05-09China rules out strong economic stimulus

2014-04-24No stimulus for a resilient economy

2014-04-15Stimulus ruled out as growth remains within target range

2014-04-12Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.