China's exports and imports rebounded in April after a sharp fall in March, official data showed Thursday, easing concerns over a further deterioration in the economy.

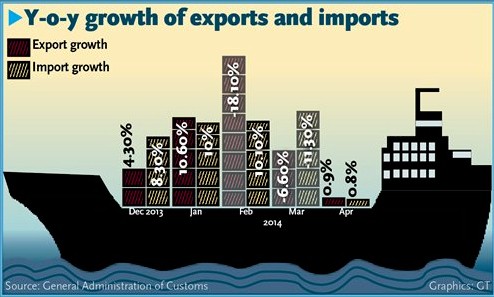

Exports rose 0.9 percent year-on-year in April, rebounding from a 6.6 percent fall in March, data from the General Administration of Customs (GAC) showed on Thursday.

Imports climbed 0.8 percent in April from a year ago, compared with an 11.3 percent drop in March, the data showed.

The figures also showed a widening in the trade surplus by 1.8 percent year-on-year to $18.45 billion in April.

"The result is better than expected but still weak. The weak import growth does not necessarily mean slow growth of demand in China, but was caused by a fall in prices of bulk commodity imports," Jin Baisong, a research fellow at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times Thursday.

Excluding base effects, exports in April should have grown by around 7 percent year-on-year to be at a normal level, Jin said.

China's trade data has remained sluggish, partly due to distortions caused by the use of fake export invoices by some Chinese exporters in early 2013 to bypass capital controls and disguise money flows.

The unusual data triggered a crackdown by the authorities on false invoices last May, leading to a significant fall back in trade figures in May from the previous month.

Thursday's data also showed that the Chinese mainland's trade with Hong Kong declined 33.1 percent year-on-year in the first four months.

But the country's trade with Europe rose 8.5 percent in the same period from a year ago, while trade with the US grew 2.4 percent.

"With the recovery of the world economy - in particular the improved economic situation in the US and Europe - China's foreign trade will continue to improve in the second and third quarters," Li Huiyong, chief economist at Shenyin & Wanguo Securities in Shanghai, told the Global Times Thursday.

The Ministry of Commerce said in a report released Monday that the country's trade is expected to improve after May and see stable growth this year.

The slight recovery of China's exports can help reduce the pressure for depreciation of the yuan. But because the recent depreciation was caused by multiple internal and external factors, the impact of improved exports on the exchange rate was weakened, Li Youhuan, a senior economist with the Guangdong Academy of Social Sciences, told the Global Times Thursday.

The spot yuan rate against the US dollar reached 6.2676 on April 30, the weakest in 18 months, closing at 6.2593 after the central bank had set its central parity rate at 6.1580 earlier that day.

The yuan's central parity rate against the dollar was set at 6.1557 Thursday.

The yuan has slumped by more than 3 percent since January, the longest run of depreciation in the China Foreign Exchange Trade System records since 2007, according to a report released by Bloomberg in April.

In a quarterly monetary policy report released Tuesday, the central bank pledged to keep the yuan stable while increasing the two-way flexibility in the exchange rate. As concerns over a further slowdown in China's economy ease and the effect of the US pullback from its monetary easing policy diminishes, the yuan will see a reverse in its recent depreciation, said Li at Shenyin & Wanguo Securities.

The National Bureau of Statistics is set to publish a series of economic data Friday, including the Consumer Price Index and Producer Price Index.

Meanwhile, Premier Li Keqiang said at the World Economic Forum on Africa in Abuja, capital of Nigeria, on Thursday that China still has firm foundations for sustained growth and the country is confident it can meet the annual growth target of around 7.5 percent this year.

Export uptick a ‘warming‘ trend

2014-05-09China‘s April trade rebounds, with imports, exports both up

2014-05-08China‘s exports up 0.9 pct in April

2014-05-08China‘s economy stable, trade negative

2014-05-08China‘s April trade rebounds, with imports, exports both up

2014-05-08China‘s foreign trade down 0.5 pct in Jan-April

2014-05-08Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.