Customers choose gold jewelry at a shop in Xuchang, Henan province, during the May Day holiday. China's gold jewelry consumption jumped 30.2 percent year-on-year in the first quarter of this year to 232.53 metric tons. GENG GUOQING/CHINA DAILY

China's gold consumption in the first quarter of 2014 eased significantly from last year mainly because of reduced demand for giftrelated gold bars, experts said on Tuesday.

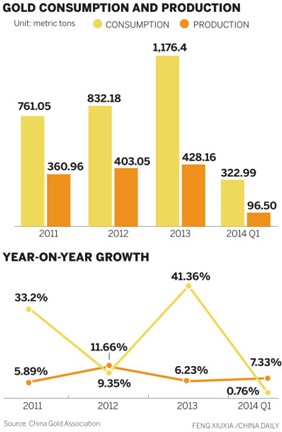

In the January-March period, gold consumption was 322.99 metric tons, rising 2.45 tons or 0.76 percent year-on-year. Gold jewelry purchases jumped 30.2 percent to 232.53 tons, while gold bar consumption slumped 43.56 percent to 67.95 tons, the China Gold Association said.

Albert Cheng, Far East managing director of the World Gold Council, told China Daily that the "slump of gold bar demand was caused by the decline of gifts" as the government tightened rules on giftgiving by officials.

"On the whole, China's gold consumption in the first quarter maintained growth, which is very satisfactory, as 2013 was an unusual year for the gold markets in China and the world. China's gold demand rose very strongly last year, and demand this year will noticeably slow down," Cheng said.

He added that China's demand for gold will maintain a growth rate of 20 to 25 percent in the next four years.

"Investment is a very important factor in China's gold demand. The emerging middle class and the ongoing urbanization are the most crucial force in driving up the gold demand in China. The price, which was quite stable in the first quarter, also supported the robust increase in gold jewelry consumption," Cheng said.

In 2013, China became the world's largest gold producer, consumer and importer. Gold consumption surged 41.36 percent, while gold production went up 6.23 percent year-on-year, according to the association.

A report from the WGC said on April 15 that following the record level of Chinese demand in 2013, this year would likely see consolidation and succeeding years would see steady growth.

"Despite the steep growth in demand, the Chinese gold market will continue to expand, irrespective of short-term blips in the economy. The private sector demand for gold in China is set to increase from the current level of 1,132 tons per year to at least 1,350 tons by 2017," the report said.

In addition to a growing middle class, rising real incomes, a deepening pool of private savings and rapid urbanization across China suggest that the outlook for gold jewelry and investment demand in the next four years will remain strong, the report added.

Jeffrey M. Christian, managing partner of CPM Group LLC in New York, said China's demand will decide American and European investors' mindset and confidence in the global gold market.

But China does not have a big influence on gold pricing despite the astonishing increase in gold demand since the liberalization of the gold market in the late 1990s and the subsequent offering of gold bullion products by local commercial banks starting in 2004.

"The gold price will remain weak in the near future, while China's gold industry will be confronted by great challenges. Domestic enterprises must join hands to combat difficulties, including maintaining healthy competition, advancing technology for innovation and further reducing costs," said Song Xin, president of the China Gold Association.

On Tuesday, the association, together with the CPM and Jingyi Gold Co Ltd, launched the Chinese version of the CPM Gold Yearbook 2014.

The yearbook said that while the macroeconomic environment remains a leading factor affecting gold demand, investors' attitude and faith are what is most important.

In the first quarter of this year, China's gold production reached 96.50 tons, with an increase of 7.33 percent from a year earlier. Breaking down those numbers, mine production rose 5.88 percent to 79.15 tons, while secondary nonferrous output rose 14.47 percent to 17.35 tons.

Gold futures lose 28 pct for 2013

2014-01-01Gold futures settle under $1,300

2014-04-29Gold drops on technical selling

2014-04-22Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.