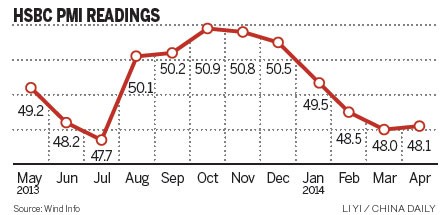

Workers test flat screen television sets on an assembly line in Lianyungang, Jiangsu province. The final reading of the HSBC Holdings Plc Purchasing Managers Index for April came in at 48.1,below the preliminary reading of 48.3. Geng Yuhe / For China Daily

China's manufacturing sector failed to make a strong comeback in April, while the service sector continued to expand, underscoring the changing growth pattern in the world's second-largest economy.

The final reading of the HSBC Holdings Plc and Markit Economics Purchasing Managers Index for April came in at 48.1, below the preliminary reading of 48.3 but up slightly from an eight-month low of 48.0 in March. It was the fourth month that the sector contracted.

The HSBC/Markit reading was in line with an earlier official PMI reading for April, both showing marginal improvement in the manufacturing sector. The official PMI, released by the National Bureau of Statistics and the China Federation of Logistics and Purchasing, rose to 50.4 from 50.3 in March, indicating a slight expansion.

The official PMI is weighted more toward bigger and State-owned enterprises, while the HSBC/Markit survey focuses on smaller private companies.

Analysts said the slower decline of the new orders sub-index indicated a marginal improvement in domestic demand, while the new export order sub-index indicated deteriorating export conditions.

"The latest data implied that domestic demand contracted at a slower pace but remained sluggish. Meanwhile, both the new export orders and employment sub-indexes contracted, and were revised down from the earlier flash readings," said Qu Hongbin, chief economist for China at HSBC.

"These indicate that the manufacturing sector, and the broader economy as a whole, continues to lose momentum," he added.

In the official PMI reading, new export orders in April dipped below 50, the point that separates expansion from contraction. Zhao Qinghe, an analyst with the NBS, noted that although the new orders index has been faring better than the new export index since mid-2012, the gap widened to 2.1 percentage point in April from an average of 1.9 percentage point during the period.

"This showed that domestic demand's contribution to manufacturing continued to rise, and the domestic market increasingly became the main engine of manufacturing growth," Zhao said.

But the new export orders index was a sign that export conditions in April were probably weak. Official trade figures for the month won't be released until Thursday, but Ministry of Commerce officials have repeatedly cautioned that the data could be disappointing. The government has introduced measures to stabilize the export sector.

Beyond exports, the State Council (the cabinet) in March outlined a package of spending on railways and subsidized housing and tax cuts to support growth. To stabilize investment, which is crucial for China's economy, China Railway Corp plans to increase this year's investment to more than 800 billion yuan ($128 billion) from a previously announced 720 billion yuan, business publication Caixin reported last week. The amount had already been raised twice this year from an original 630 billion yuan to 700 billion yuan and then to 720 billion yuan.

"Beijing has introduced more reform measures that could support growth by inducing more private-sector investment," Qu said. "We think bolder actions will be required to ensure the economy regains its momentum."

While most analysts believe the manufacturing sector is unlikely to see an upturn in the short term because of high inventory levels, the services industry fared a little better last month, according to the official PMI.

The PMI for the services industry rose to 54.8 in April from 54.5 in March, the NBS said over the weekend.

The output of tertiary industry, mostly services, generated 46.1 percent of China's GDP last year, rising to 49 percent in the first quarter of this year.

"I think many China observers missed the structural change; that is, the rise of the service industry," said Fan Jianping, chief economist of the State Information Center, a government think tank.

"This is why many analysts underestimated China's GDP growth in the first quarter as they just focused on industrial output. This is also why employment remains stable so far despite a slowdown in manufacturing, because the service sector is far better at creating jobs."

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.