China's national railway operator has raised its fixed-assets investment target to more than 800 billion yuan ($127.2 billion) for 2014, which is part of the country's efforts to stabilize growth through infrastructure construction, experts said Saturday.

The announcement was made during a company conference held by China Railway Corporation (CRC) on Wednesday, financial news website caixin.com reported Thursday. CRC was unavailable to comment due to being closed during Labor Day holidays running from Thursday to Saturday.

Boosted by the news, rail-related shares rose on Hong Kong's stock exchange on Friday. China Railway Group Ltd surged 9.275 percent while China Railway Construction Group gained by 7.332 percent.

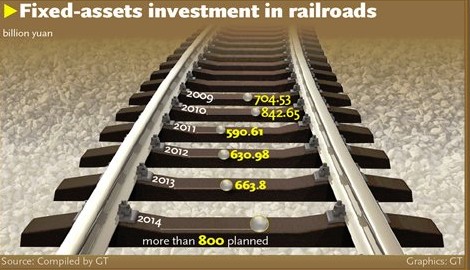

This is the third time that CRC has raised its railway investment budget for 2014 since the beginning of this year. The State-owned firm released a plan in January for fixed-assets investment of 630 billion yuan. It then raised it to 700 billion yuan, and again to 720 billion yuan in April.

The latest increase in investment came after the State Council's decision to moderately raise fixed-assets investment in railways, build more railway lines and attract private investment into the rail sector, according to a statement published on CRC's website on Wednesday.

A State Council meeting held on April 2 also decided that China will speed up railway construction in its central and western regions.

The fixed-assets railway investment budget for 2014 is likely to further increase and the final investment figure is expected to reach a new high, surpassing the record annual investment of 842.65 billion yuan in 2010, caixin.com said, citing people close to CRC.

Rail investment slumped by nearly 30 percent year-on-year in 2011, when a high-speed train crash on July 23 in Wenzhou, East China's Zhejiang Province killed 40 people. But investment has risen slightly since then.

The CRC's move is seen as part of China's efforts to stabilize growth, following a batch of disappointing economic data in the first quarter of this year, experts said.

"Increasing railway investment will not only boost economic growth but will also help balance the development among different regions, as rail infrastructure in western regions has lagged far behind that in eastern regions," Dong Yan, a transportation research fellow with the Academy of Macroeconomic Research under the National Development and Reform Commission, told the Global Times Saturday.

China is facing increasing difficulty in stabilizing growth this year as the real estate market has slowed down, so the central government is likely to increase support for the railway sector, analysts from GF Securities said in a research note on April 21.

However, fixed-assets investment in railways only amounted to 71.3 billion yuan in the first quarter of 2014, up 6.4 percent year-on-year, according to data from the Ministry of Transport, raising concerns that CRC's target will be hard to reach.

"CRC will face great pressure to fund the investment, given its high financing costs and already heavy debt," Zhao Jian, a professor with the School of Economics and Management at Beijing Jiaotong University, told the Global Times Saturday.

The railway firm had debts of over 3.06 trillion yuan and its debt-to-asset ratio climbed to 63 percent as of September 30, 2013, according to the latest data from CRC.

Zhao also said CRC's debt level will continue to increase as investment expands.

"The central government plans to build more railways in central and western regions, but private investors are not interested in these projects because of low profitability and potential losses," he said.

According to Dong, the central government will be responsible for the majority of funding for rail projects in less-developed areas.

"It's not just about business, as improving rail infrastructure in western regions has strategic importance," he said.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.