China's central bank announced Tuesday that it will cut the amount of cash that some rural banks need to hold in reserve, noting that this will boost cre-dit in rural areas but will not have a big impact on overall liquidity.

The People's Bank of China (PBOC) will cut the reserve requirement ratio (RRR) for rural commercial banks at the county level by 2 percentage points and for rural credit cooperatives by 0.5 percentage points, effective from Friday.

The adjustment will help direct more credit flows to rural areas and increase financial support for vulnerable areas of the national economy, the PBC said in a statement.

However, the move does not represent a change in direction from the country's prudent monetary policy and will not affect the overall liquidity in the banking system, the PBC said in a separate statement.

On April 16, Premier Li Keqiang said at a regular executive meeting of the State Council that the country will reduce the RRR for eligible commercial banks in rural areas to increase financial support for the agricultural sector.

Li's announcement came early on the same day that China released its first-quarter economic data, which showed the country's GDP grew 7.4 percent year-on-year, down from the 7.7 percent growth in the previous quarter and the weakest growth since the third quarter of 2012.

Many analysts interpreted the fact the two announcements came on the same day as a sign that monetary easing would be used to spur the economy.

"The cut is only a targeted measure rather than universal monetary policy. It is not a beginning of monetary easing nor an end to it," Li Huiyong, chief economist at Shenyin & Wanguo Securities in Shanghai, told the Global Times on Tuesday.

"Tuesday's measure is an extension to an old policy introduced in 2010. The targeted RRR cut should not be interpreted as a specific measure to stimulate the economy," Li said.

According to the PBC statement, following the measures to increase lending for rural development in 2010, the new cut will allow some eligible rural banks to hand over as little as 13 percent of customer deposits for reserves at the central bank.

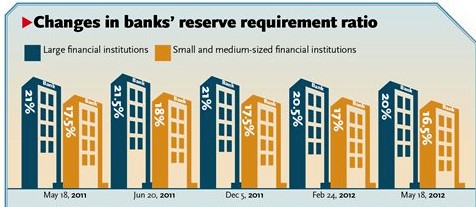

China has different RRR levels for different banks. The requirement for bigger banks is currently 20 percent. Lowering the RRR, which could have the effect of boosting bank lending, is usually viewed as a measure to pump up economic growth. China last announced an RRR cut in May 2012.

"The fact that the central bank still conducts repurchase operations to drain money from the money market signals that liquidity in the banking system is still at a reasonable level," E Yongjian, an analyst with the Bank of Communications in Shanghai, told the Global Times on Tuesday.

"China will not lower the RRR for major banks in the short term, at least not within the year," E said, noting that while big stimulus will not be announced, there might be some mini-stimulus measures.

Unlike major stimulus to arrest a slowdown in the economy, the government has taken smaller moves such as tax breaks for micro and small-sized firms and plans to speed up construction of railway lines and renovate run-down areas.

Premier Li said early this month at the annual meeting of the Boao Forum for Asia in South China's Hainan Pro-vince that the country will not resort to major short-term stimulus measures to boost the economy, despite recent fluctuations.

"We expect the targeted RRR [cut] will only release around 70 or 80 billion yuan into the money market, which will have a limited impact on boosting the economy," Zhang Lei, a macroeconomic analyst with Minsheng Securities, told the Global Times on Tuesday.

Separately, the State Council announced Tuesday that the country will encourage the establishment of venture capital and private equity funds to boost financial support for rural areas.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.