CreditEase, one of China's leading peer-to-peer (P2P) lenders, denied on Thursday reports that it had defaulted on 800 million yuan ($128.77 million) in loans, saying the risks of its projects were controllable.

Meanwhile, an official of China Banking Regulatory Commission (CBRC) said Thursday that it would take the lead in P2P supervision.

CreditEase on Thursday e-mailed the Global Times a statement, which said that it was groundless for media outlets to report that the firm had defaulted on 800 million yuan in real estate-related loans in Northeast China and its borrowers had engaged in forgery and fled.

CreditEase has many real estate projects in Northeast China but the total value of loans made there is far less than 800 million yuan, the statement said.

CreditEase stated that its borrowers did not engage in forgery nor flee. All the maturing loans can be repaid and the risks are controllable, it said.

CreditEase was reported to have defaulted on 800 million yuan in loans on Wednesday by several newspapers. Guangzhou Daily reported Thursday that bad loans for CreditEase may have reached 1 billion yuan instead of 800 million yuan, involving projects such as real estate, energy and bulk commodities, citing an unnamed source.

"If the default did happen, CreditEase may experience a cash flow shortage in a short time as investors rush to get their money back," Zhang Lei, a macroeconomic analyst with Minsheng Securities, told the Global Times on Thursday.

"Even if CreditEase had 800 million yuan in bad loans, the company won't go insolvent. Its bad debt rate would be kept at 10 percent given the large value of funds it managed," Ma Jun, chief analyst at Shanghai-based wangdaizhijia.com, a Web portal that tracks the industry, told the Global Times on Thursday.

CreditEase, established in 2006 in Beijing, mainly specializes in off-line P2P lending. In 2012, the company launched yirendai.com, an online P2P lending platform, to capitalize on the boom of the country's Internet financing.

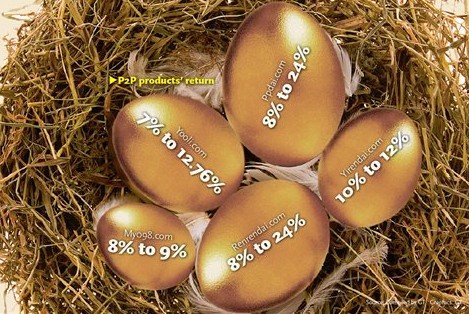

P2P lending platforms match people who want to invest money with individuals who are seeking loans, usually via online auctions. P2P lending has developed rapidly since the end of 2012 as part of the country's unregulated shadow-banking system.

However, due to low entry barriers and because many P2P companies lend to some of the country's riskiest borrowers, the risk of default and fraud remains high.

By the end of 2013, the number of online P2P lending companies in China exceeded 800 with outstanding loans of 26.8 billion yuan, according to wangdaizhijia.com. A total of 74 online platforms were either shut down or investors were unable to get their cash back, wangdaizhijia.com said.

"P2P lending has experienced a boom in the last two years as the government tightened the monetary supply and lending, making it difficult to borrow from the traditional banking sector," said Zhang.

The explosion of risks of P2P platforms will peak in the second and third quarter of the year as many projects financed through these platforms will mature, according to Zhang.

In the latest case, managers of China-Europe Winton Fund, a Beijing-based P2P platform, disappeared in February with around 2,000 investors unable to retrieve their funds worth 400 million yuan, news portal eeo.com.cn reported in March.

Yan Qingmin, vice chairman of CBRC, revealed on Thursday during the ongoing Boao Forum for Asia that CBRC would take the lead in supervising P2P, but also admitted the work has just begun and a detailed plan is still pending.

Given the current situation, the CBRC may not issue licenses to P2P firms as a way to supervise them, Ma from wangdaizhijia.com said. Instead, the regulator may adopt the "negative list" by stating what P2P companies can and cannot do, he added.

China‘s P2P lender PPDai hits the jackpot

2014-04-10Three P2P pioneers take stock at 30

2014-02-27Parent of China P2P lender raises 130 mln USD

2014-01-10PBOC warns P2P businesses over fraud

2013-12-06Third-party platform set up to monitor P2P lending

2013-12-03PBOC to set up P2P custodians to prevent fraud

2013-11-27Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.