China's real estate sector is cooling and profit margins for developers will get thinner in the future, experts said Tuesday, after several major developers reported slower growth in 2013.

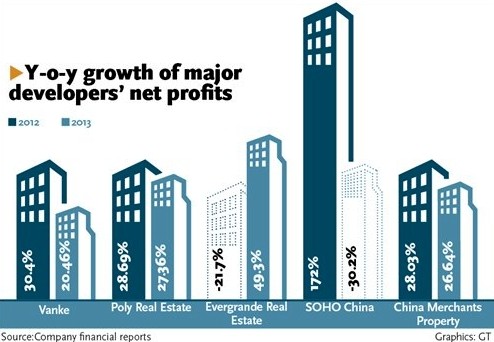

Leading developer Poly Real Estate Group on Tuesday reported net profit for 2013 of 10.7 billion yuan ($1.72 billion), up 27.36 percent year-on-year, slower than the 28.69 percent year-on-year growth in 2012.

China Vanke, the country's largest listed developer in terms of revenue, saw its net profit grow 20.46 percent year-on-year to 15.1 billion yuan in 2013, the company said on March 7, compared to a 30.4 percent growth rate in 2012.

"Developers' profit growth rate is generally becoming flatter, and this will be a long-term trend," Hui Jian-qiang, research director with real estate information provider Beijing Zhongfangyanxie Technology Service, told the Global Times Tuesday.

Along with the slower profit growth, there has also been news that some companies in the real estate sector are lowering prices in order to boost sales.

Earlier this month, a China Vanke residential project in Beijing went on sale at a price at least 3,000 yuan per square meter lower than market expectations.

There have also been discounts on offer recently at several housing pro-jects in Guangzhou, capital of South China's Guangdong Province.

Experts said that the days when developers could reap massive profits are long gone, and margins in the sector are falling to a more reasonable level.

Among the 76 developers that had released annual reports as of Sunday, over half saw declining profit margins in 2013, Guangdong-based newspaper Nanfang Daily reported Tuesday, citing data from Shanghai Wind Information Co.

Liu Yuan, a research manager at Centaline China Property Research Center, noted that higher land prices, higher financing costs and the cooling high-end real estate market are three major reasons behind developers' declining profit margins.

"Developers can only rely on a higher turnover rate and larger business scale to guarantee profit growth," Liu said, adding that only a small group of developers will be able to maintain strong growth in the future.

Liu noted that companies that focus more on mid-level housing could better weather the current slowdown, given that it is high-end housing that has been hit harder.

There have been other signs that China's real estate sector is losing steam.

In the first quarter of this year, residential housing transactions in Beijing dropped around 60 percent, according to data from real estate agency Homelink.

Liu noted that residential housing transactions in Shanghai and Guangzhou also dropped around 30 percent in the first quarter.

In March, average housing prices in the country's 100 biggest cities rose 10.04 percent year-on-year, compared with 10.79 percent growth in February - making March the third consecutive month of slowing year-on-year growth - according to data released Tuesday by the China Real Estate Index System.

As well as declining transactions and cooling growth, there have been suggestions that the sector may face a more severe downturn in the future, especially in some third- and fourth-tier cities where oversupply has become a serious problem.

But experts noted that a meltdown in the sector is unlikely and that it will remain relatively stable. First-tier -ci-ties will see housing prices continue to increase this year, and the market will also gradually consume the supply in lower-tier cities, Hui said.

Home prices stagnate, purchases fall

2014-04-02Property prices stabilize in March

2014-04-01Vanke taking guarded property outlook

2014-04-01Property market shows signs of cooling down

2014-03-30Property registration underway

2014-03-28Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.