Chinese e-commerce giant Alibaba Group Holding Ltd announced Monday that it will invest HK$5.37 billion ($692.2 million) in Intime Retail Group Co Ltd.

The move is the latest step in Alibaba's strategy to integrate its online and offline business, analysts said.

Alibaba will spend HK$5.37 billion to buy 9.9 percent of Intime's stake and also its convertible bonds worth HK$3.71 billion, according to a statement released by Alibaba on its Weibo account Monday.

Within three years after Alibaba's investment, the bonds can be converted into Intime's conversion shares and then Alibaba will have no less than 25 percent stake in Intime, the statement said.

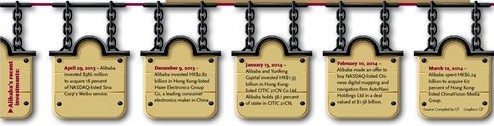

Alibaba, which owns one of China's largest e-commerce portals and online fund products, has been expanding aggressively in the online-to-offline (O2O) segment. It has bought its way into companies in markets ranging from digital mapping to media since 2013.

Intime and Alibaba have agreed to establish a joint venture, which is expected to develop O2O business that relates to shopping malls, department stores and supermarkets, according to a statement that Intime filed on the Hong Kong Stock Exchange Monday.

By leveraging the expertise, resource and infrastructure of Intime's retail business network across China and Alibaba's leading e-commerce platform, Alibaba and Intime plan to build an O2O system, which will also be open to other retailing groups.

The key to the O2O strategy is to find consumers in online venues, such as e-commerce platforms and restaurant rating websites, and bring them offline to brick-and-mortar malls, movie theaters and so forth, experts said.

Feng Lin, an analyst at the China E-Commerce Research Center, told the Global Times Monday that O2O is an inevitable trend for the retailing industry and the cooperation with Alibaba shows Intime's vision for future development.

Intime has its own e-commerce website yintai.com and cooperation with Alibaba can increase traffic to the webiste, Feng said, and the plan to build an open O2O system may be too ambitious.

E-commerce platforms usually attract customers with high discounts that are actually provided by sellers and may not last long, Feng said.

Lu Zhenwang, CEO of Shanghai Wanqing Commerce Consulting, said that an O2O system will take a long time to be established and it should be started with cooperation on mobile payment.

After deal is completed, Alibaba and Intime will connect their systems in terms of products, payment and customer membership.

As of the end of last year, Intime has 28 department stores and 8 shopping malls in China, according to the statement from Alibaba. Intime also has a product database containing nearly 10 million products and 1.5 million customers, the statement said.

The investment is not the first cooperation between Alibaba and Intime.

Back in 2010 and 2011, Alibaba set up two micro credit companies and Intime was one of the investors.

In May of 2013, Alibaba established a logistics company Cainiao Network Technology Co. Intime invested 1.6 billion yuan for a 32 percent stake and Shen Guojun, chairman of Intime, was appointed the CEO of Cainiao.

Intime launched a shop on Alibaba's tmall.com marketplace on November 11 last year, also known as the Singles' Day in China.

Alibaba's recent heavy investments in mapping, entertainment and social networking firms are seen as part of the company's preparation for an IPO in the US, which may become the largest technology listing, even bigger than Facebook Inc's $16 billion listing in 2012, Reuters reported Monday.

Intime's share price surged 16.3 percent after the market opened on Monday but closed with 7.53 percent drop on the same day.

Alibaba buys into retail business

2014-03-31Alibaba hopes to continue cooperating with major banks, says executive

2014-03-31Alibaba starts entertainment funding platform

2014-03-27Alibaba investing in US messaging startup Tango

2014-03-21Alibaba close to deciding on New York IPO

2014-03-14Alibaba expands its footprint into media

2014-03-13Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.