With inventories rising amid an intense price war, auto dealers in China are having a tough time making a profit, according to a report by British consulting firm Deloitte.

Dealer margins are hurt by their heavy reliance on new vehicle sales, a challenge compounded by rising operational, labor and financing costs, said the report based on surveys and in-depth interviews with dealers.

The report said one cause for dealer doldrums is the low percentage of revenues from parts and after-sales services.

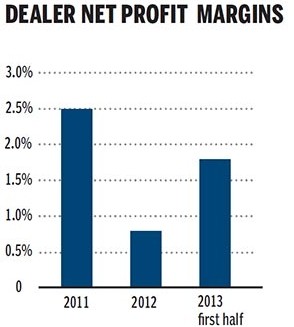

Deloitte said the average profit margin at Chinese auto dealers was less than 2 percent of revenues in the first half of 2013, well below the industry benchmark of 3 percent.

Statistics also show that the ratio of dealer overheads - which include expenses in sales, management and financing - was more than 7 by the end of 2013, up 1 percent from the previous year.

Since 2011, Deloitte has researched and surveyed auto dealer performance to provide insights about the risks and challenges in the industry. It then formulates strategies to address problems.

Its latest report was based on a questionnaire and nearly 100 interviews with executives at auto dealers and carmakers in China.

"While auto sales will be buoyed by sustained economic growth, the structure of the auto market is not mature, compared with the Western world," said Winhon Chow, a managing partner at Deloitte China.

"Heavy reliance on new car sales can leave overall profitability exposed to uncertainties in the external environment. There is a long way to go for the profit structure to tilt toward the back-end segments (of parts and services). Chinese auto dealers also need to bear the brunt of increased overheads."

After years of rapid development, the Chinese auto market began to slow in 2011. In the wake of the global economic recovery, there has been a moderate but steady rebound over the last three years.

Modest growth

Sales growth has continued at a single-digit pace and prospects remain weak as the industry matures. After years of high-gear expansion, the auto dealership sector now faces an era of modest growth, according to Deloitte.

New challenges include high risk of cash liquidity problems and piling-up inventory.

In the first half of 2013, a drastic increase in production amid modest growth in sales led to excessive inventory. Some 74 percent of survey respondents attributed the oversupply to fierce market competition.

The Deloitte report said high inventories will give rise to funding and liquidity problems exacerbated by the lack of external financing and scarcity of internal capital at dealerships.

"After all, it is a capital intensive industry - auto dealers have always been operating with great balance sheet stress. Usually, they are highly leveraged to meet capital needs. Loans from local commercial banks are cited by 64 percent of respondents to be one of their major sources of financing," said Chow.

One of the emerging trends in the industry is expansion of sales networks into second and third-tier cities, partly due to government purchase restrictions in mature first-tier cities and partly because of pent-up consumer demand in smaller cities.

But the trend will make it harder for auto dealers to manage their sales networks, especially when qualified management and technical professionals are in short supply in lower-tier cities, said the Deloitte report.

With the steady recovery of China's auto market offset by challenges that emerged in 2013, the report advocated stronger cooperation among automakers, dealer groups and independent dealers, as well as tighter controls on capital, expenses and staff.

The report also highlighted the need for staff retention and transformation of the overall business model.

Auto sales to rise by double digits in 2014

2014-03-11Govt ponders raising cap on foreign stakes in auto JV

2014-03-10China auto sales down from record high

2014-03-10Auto industry put pedal to metal

2014-02-17Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.