A container ship readies to leave the Jinling Shipyard in Nanjing, Jiangsu province. China has 1,600 shipbuilding-related enterprises, many with excess capacity. The government plans to rationalize the industry. Provided to China Daily

China signaled that it will cut its vast shipyard army to get industrial growth back on a healthy track this year, as its earning ability falters amid cheap vessel prices, blind expansion and speculation in the shipbuilding sector.

China will drastically curb the number of shipyards, docks, berths and maintenance facilities it opens, said Li Dong, deputy director-general at the department of equipment industry at the Ministry of Industry and Information Technology.

"Blind investment activities in the shipbuilding sector must be restrained, especially in the regions of the Bohai Bay, Pearl River Delta and Yangtze River Delta," Li said.

Meanwhile, he said, "capable shipyards will be supplied with technical and financial assistance to develop high-end ships and offshore engineering products to catch up with rivals such as South Korea and Singapore".

As China's policy banks, such as China Development Bank and the Export-Import Bank of China, become more cautious in approving refund guarantees-in particular, small and medium-sized shipyards-Li warned that unqualified shipyards should not even think about producing offshore engineering products such as oil rigs and offshore pipe-laying vessels for foreign ship owners.

"Small and medium-sized shipyards without orders or with a few orders will gradually withdraw from the market over the next five years," Li said.

As the world's largest shipbuilding country, China has 1,600 shipbuilding-related enterprises (including 800 large shipyards), with an annual industrial output value of 800 billion yuan ($130 billion).

A total of 1.5 million people work in the industry, according to the National Development and Reform Commission.

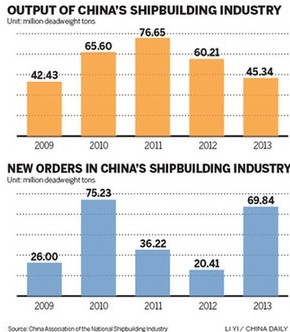

New orders hit 69.84 million deadweight tons in 2013, up 242 percent from a year earlier.

Ongoing orders totaled 131 million DWT, a 23 percent rise year-on-year.

"Even though China received more orders than Japan or South Korea last year and this year, new ship prices hit rock bottom over the past two years, and there is no sign of recovery," said Zhang Guangqin, president of China Association of the National Shipbuilding Industry. "It will take another five years for overcapacity to be eased."

Concrete action already has been taken by major shipbuilding provinces. Shanghai announced earlier this month that it will cut its shipbuilding capacity to 12 million DWT before 2017.

Jiangsu also promised to cut 10 million DWT of shipbuilding capacity, down to 25 million DWT over the next five years.

In the meantime, the development and reform commission of Zhejiang province is drafting a plan to consolidate large shipyards and eliminate small and low-end shipyards within five years.

The province is eager to optimize all its resources to develop high-end vessels and offshore engineering products such as liquefied natural gas carriers, drilling vessels, large icebreakers and chemical tankers.

Dong Liwan, a professor at Shanghai Maritime University, said the Crimea issue between Russia and the West will create an opportunity for Chinese shipyards to get orders from Europe for LNG carriers.

"Russia may cut its natural gas supply to some members of the European Union if the conflict in Crimea continues to escalate. Therefore, countries such as Britain, Germany and Italy will turn to theirshale gas-rich ally the United States to resolve a possible energy crisis sooner or later," Dong said.

The world's LNG ship market is dominated by South Korea, Japan and China. South Korea became the world's largest LNG vessel manufacturer last year, holding 68 percent of global orders. But its production capacity is already saturated.

Japan faces the similar problem of currently producing LNG ships for domestic companies to secure its natural gas supply on sea routes, after the nuclear leak in Fukushima in 2011.

"Under such circumstances, those European nations have no choice but to order a considerable number of LNG ships from China to ensure they can get sufficient gas from a seller across the Atlantic," said Dong. "LNG ships also are a good product with which China can upgrade its shipbuilding sector."

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.