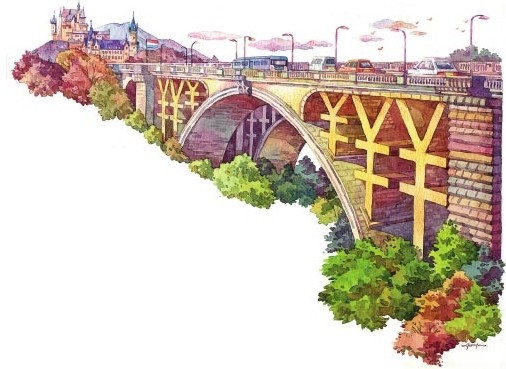

Grand Duchy sets its sights on being European hub for renminbi trade

Although the renminbi has attracted a host of suitors from across the world, it is banking on a small European nation to boost its global standing as an investment currency.

Move over London, Frankfurt and Paris. The Grand Duchy of Luxembourg, a tiny land-locked Western European nation, seems to be far ahead of others when it comes to attracting renminbi business in Europe, sources say.

"Luxembourg has played a key role in increasing the liquidity of the Chinese currency globally," says Nicolas Mackel, chief executive of Luxembourg for Finance, an agency that works for the development of the financial sector in Luxembourg.

The Grand Duchy, which hosts the European headquarters of three major Chinese lenders, has issued 44 renminbi bonds to date and is home to a growing number of renminbi-focused funds. Unlike London, Frankfurt and Paris, which boast of natural advantages such as bigger trade flows with China and familiarity with investors, Luxembourg is banking on its position as an important investment and finance hub in Europe.

According to sources, cities such as London have not been that popular with Chinese lenders because of the unfavorable environment and strict regulations. London has issued only four renminbi bonds to date, although it had a head start over other cities in Europe.

On the other hand, the big concentration of Chinese banks in Luxembourg has ensured that it has become an important part of China's outbound trade, finance, investment and mergers and acquisition deals in Europe. This has also helped boost the scale and liquidity of the offshore renminbi pool in Luxembourg, sources say.

"Luxembourg's trade with China is tiny. But any currency on its way to being a global reserve currency has to be a trade currency and also an investment currency, which is where we come in," Mackel says.

According to official figures as of December 2013, Luxembourg has the largest pool of renminbi in the eurozone with 64 billion yuan ($10.42 billion) in deposits, 53.8 billion yuan in loans, 24.7 billion yuan in renminbi bond listings and 256.4 billion yuan in renminbi-denominated assets held in investment funds.

Luxembourg finance minister Pierre Gramegna recently indicated that he would press for the setting up of an official renminbi-clearing bank and for an RQFII quota during his upcoming trip to China.

RQFII, which stands for Renminbi Qualified Foreign Institutional Investors, is a program launched by the Chinese government in 2011 that allows qualified overseas financial institutional investors from overseas to invest in China's onshore financial markets directly using the renminbi.

An official clearing bank facilitates the efficient clearing of offshore renminbi transactions, achieved through the appointed bank's direct cooperation with the People's Bank of China, the Chinese central bank.

One of the key drivers behind the growth of renminbi transactions in Luxembourg is the city's growing number of funds that invest in renminbi opportunities. These funds, collectively called UCITS, which stands for Undertakings for Collective Investment in Transferable Securities Directives, are recognized by institutional investors globally, especially in Asia and Latin America.

For this reason, an increasing number of fund managers create UCITS in Luxembourg for global distribution and a growing number of these UCITS focus on investing in offshore renminbi products including "dim sum" bonds, sources say. Dim sum bonds are bonds issued outside China and issued in yuan.

"There are many Luxembourg-based UCITS funds that invest in the offshore renminbi market," says Stefano Chao, an investment manager at AZ Investment Management, which is a subsidiary of Italy's largest independent asset manager Azimut Holding.

"When we talk to institutional investors in Latin America and Asia, they feel comfortable about investing in UCITS. Luxembourg in this sense is a good jumping point for the internationalization of the renminbi, because Luxembourg funds that invest in renminbi can be bought by international investors globally," Chao says.

Luxembourg wants bank for yuan deals

2014-02-27London to develop further as yuan trading hub

2013-10-16London beats Singapore in yuan business

2013-06-14RMB clearing bank in London within sight

2014-02-21Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.