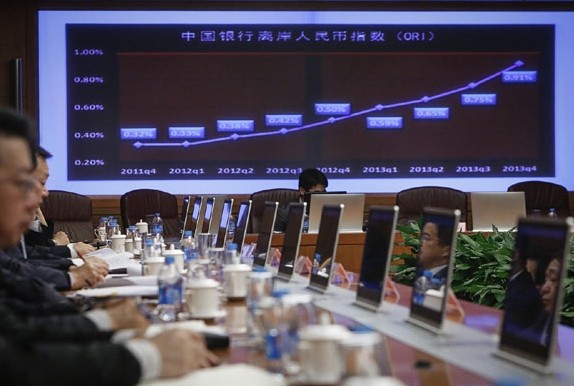

Bank of China Ltd officially launches the BOC Offshore Renminbi Index in Beijing on Tuesday. The index tracks offshore use of the yuan. Kuang Linhua / China Daily

Bank of China Ltd rolled out a new index on Tuesday that tracks the development of offshore yuan as part of its pledge to build up strength overseas to cash in on the yuan's globalization.

The index tracks the yuan's offshore indicators, including the amount of deposits, loans and trading volume, to reflect the currency's level of involvement in global trade and investment.

At the end of 2013, the index's reading was 0.91 percent, representing the yuan's market share in the entire global financial market. In comparison, the reading for the US dollar, the euro and the British pounds was 48.17 percent, 25.2 percent and 5.91 percent, respectively, using the same methods of calculation.

The 0.91 percent reading for the yuan grew from 0.5 percent at the end of 2012, and 0.32 percent at the end of 2011.

"The index illustrated the yuan's rapid rise in global trade and investment, which is to continue over the next three to five years," said Chen Siqing, president of Bank of China Ltd, at a news briefing in Beijing on Tuesday.

By the end of 2013, offshore yuan deposits, an important indicator of market size, reached 1.5 trillion yuan ($245 billion).

Zhou Xiaochuan, governor of the People's Bank of China - the nation's central bank - said at a news conference on Tuesday that it still has a lot of "homework" to do regarding the yuan's globalization, but it won't forcibly promote the currency and will instead let investors decide if they want to use it.

"When it comes to promoting the yuan, we won't prearrange the speed, location and timing," Zhou told reporters in Beijing.

Zhou added the central bank might set up a currency swap line with Paris to facilitate the city's yuan trading, but whether the capital of France can become an offshore yuan center is a matter for the market to decide.

The yuan's quick rise over the past few years provided incentives to investors to hold on to the currency. Many fear the rise will stall going forward.

After a decade-long steady appreciation, the yuan lost 1.4 percent in February as markets speculated the central bank intentionally caused the depreciation to discourage speculation. Zhou dismissed that theory, saying the central bank "doesn't take sides" regarding exchange rates.

"Financial markets are more sensitive to short-term movements. But the central bank cares more about medium-and long-term movements. The short-term trend doesn't indicate the long-term movement," Zhou said.

Bank of China's Chen said a two-way floating exchange rate won't affect the yuan's rise very much globally.

"Individuals might choose to move away from the yuan if the market's appreciation expectation weakens, but corporations have reasons to use the currency other than speculation," said Chen.

Toronto seeks to become offshore yuan trading center

2014-01-16Offshore yuan loans in Qianhai to grow tenfold by 2015

2013-12-19BOCHK, FTSE launch new offshore yuan index series

2013-10-23Other offshore centers may replicate Singapore's yuan liquidity facility program

2013-08-08DBS prices maiden offshore yuan bond

2013-05-31Offshore yuan bonds issued in Singapore

2013-05-28Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.