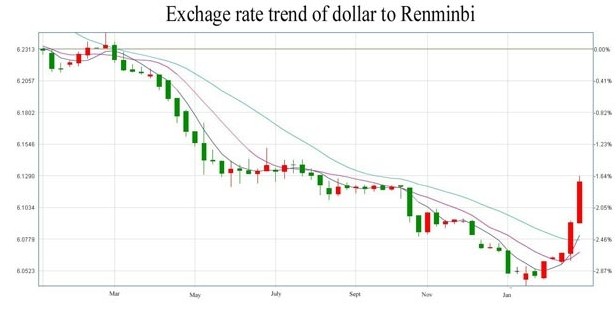

China's yuan looks set for its biggest daily loss on record on Friday, as the central bank stepped up its intervention to weaken the currency ahead of a key government meeting next week which may be used as a platform to unveil more market reforms.

Directed at squeezing out speculative plays betting on continued yuan gains, the central bank has set about actively weakening its currency since mid-last week by using a mix of weak daily fixings and asking its agent banks to buy dollars.

Its intervention reached a frenzied pitch on Friday with the onshore yuan falling by its daily one percent limit against a midpoint fixing for the first time since July 2012.

Some analysts expect more weakness in the coming days.In midday trades, the yuan briefly weakened to 6.1808 per dollar, more than 0.8 percent below Thursday's close despite the central bank fixing the yuan slightly stronger at 6.1214 per dollar. The yuan could post its biggest-ever weekly loss around 1.2 percent.

"I think there is good chance for the spot yuan to break the 6.20 psychologically important level, and it can happen as early as next week," said Kenix Lai, a senior market analyst at Bank of East Asia. "Only fast depreciation of the yuan can stamp out speculative money betting on yuan appreciation."

Stepped-up efforts by the People's Bank of China to actively weaken the currency has led the yuan to a dramatic weakening

cycle that many analysts believe may be a prelude to more foreign exchange market reforms including widening a daily

trading band at an annual parliamentary meeting next week. While the yuan has been allowed to move in a 1 percent

trading band against the US dollar on either side of the central bank's daily reference rate since April 2012, it has mostly hugged the stronger end of the band.

The Chinese yuan has firmed every year against the dollar since 2010 with recent gains coming amid very little volatility

and despite widespread weakness among emerging market currencies, fuelling growth of speculative capital flows.

Those hot-money inflows -- UBS estimates that amount at more than $150 billion in 2013 -- have complicated the task of the central bank's policy management as it seeks to curb the growth of shadow banking activities.

The yuan's dramatic fall since last week is aimed at stamping out those speculative plays.

"Have you changed your expection of the yuan to depreciation? If not, I suggest changing it as soon as possible.

I have changed mine and think it will stay weak for the next three months," said a trader at a Chinese bank in Shanghai.

Regarding the yuan's recent sharp decline, China's foreign exchange regulator has launched an investigation into its possible impact on foreign exchange transactions at domestic banks and companies, banking sources said on Thursday.

Despite the slump in the past two weeks, which has seen the yuan lose 1.8 percent against the dollar, a rare phenomenon in

its history, analysts do not think it will be the trend in the long term.

The world's second-largest economy is still under pressure from heavy capital inflows both under the current account and

the capital account. Higher interest rate levels and better economic fundamentals will continue to attract fund inflows.

The market is keeping a close eye on the National People's Congress to be held from next Wednesday, as traders think it may be the time the central bank announces important policies on the foreign exchange market.

China yuan weakens to 6.1224 against USD Thursday

2014-02-27Two-way yuan fluctuation normal: SAFE

2014-02-27Yuan sees sharp drop against dollar

2014-02-24Economic slowdown, US QE tapering frustrate strong yuan

2014-02-21Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.