(Photo: China Daily)

China's consumer health market is expected to experience an upswing in the next five years, The Boston Consulting Group said on Tuesday, saying that rising health consciousness in the world's second-largest economy will spark business opportunities.

China's growing health and wellness market is poised to reach nearly $70 billion by 2020, said BCG's Center for Consumer and Customer Insight, which surveyed 2,600 middle-and upper-income consumers aged 18 to 65 from across China.

"We project an average year-on-year growth of about 11 percent for the over-the-counter treatments segment and vitamins, minerals and supplements market between 2014 and 2020," said Wu Chun, who is a partner and managing director at BCG Greater China. The survey said that Chinese consumers are willing to pay more for brand names and higher-quality products.

Factors behind the trend include rising incomes, stressful effects of urbanization, an aging population and ongoing issues with food safety and quality.

"Almost half of the Chinese consumers we surveyed said they feel subpar because of lifestyle factors such as work pressure, family obligations and long work hours," said Carol Liao, a BCG senior partner and co-author of the report.

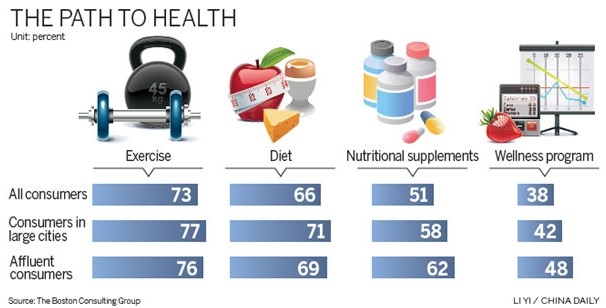

Chinese consumers are not only seeking treatments but also prevention through exercises, diet and VMS products.

More than 60 percent of consumers both from the lower economic spectrum (with annual household incomes of 120,000 yuan to 240,000 yuan) and the upper one (with annual household incomes of more than 240,000 yuan) said they believe that "taking VMS and OTC products is effective and convenient".

Traditional Chinese medicine and products with multiple functions also are popular with Chinese consumers, many of whom are concerned about the side effects of Western OTC products.

"TCM is popular with consumers of all ages, not only the older generation," said the report, adding that TCM is preferred by 55 percent of residents of large cities, compared with 35 percent in small ones.

But to get a bigger share of an increasingly attractive market, manufacturers should invest more in brand strength, product efficacy and expertise, Wu said. "Before jumping in and committing valuable resources to secure a foothold, most companies are wrestling with a variety of strategic issues, such as which consumer segments to target, which products to offer, how city size affects consumer behavior and which distribution channels to use," said Wu.

But the consumer health market in China remains quite fragmented due to a broad range of preferences, based on things like age group, city size and income level, so companies must develop product portfolios that play to distinct business strengths.

Added to this is the fact that better-known brands are considered safer and of higher quality than lesser-known brands, especially when it comes to OTC products and self-medication.

In order to capture the market, companies should focus on brand building, according to BCG.

"Companies with strong brand equity may be able to capitalize on it by extending the brand into other product areas or consumer segments," said the report.

Along with developing campaigns to educate consumers about product quality and value, as well as to correct common product misconceptions, the report said it is critical for companies to have a retail presence and shelf space in major pharmacy chains, which are considered the most important sales channel for health and wellness products.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.