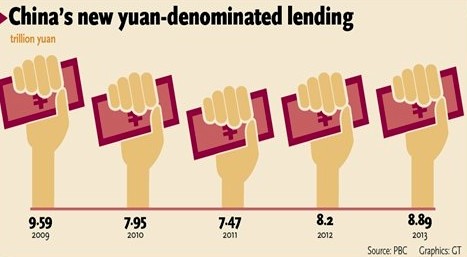

China's new yuan bank lending reached 8.89 trillion yuan ($1.47 trillion) in 2013, up 687.9 billion yuan year-on-year, according to data released Wednesday by the People's Bank of China (PBOC).

It was the highest level of new bank lending in four years.

In 2013, total yuan-denominated lending topped 71.9 trillion yuan, up 14.1 percent compared with 2012, the PBC said.

At a press conference held in Beijing on Wednesday, Sheng Songcheng, -financial survey and statistics chief at the PBOC, said that financial efforts were made in 2013 to aid less--developed areas and sectors, in a bid to support economic restructuring.

Total bank lending in the western part of China increased by 17.1 percent year-on-year in 2013, higher than the growth of 11.9 percent and 15.9 percent in East and Central China, and loans to small and micro-enterprises also grew faster than those to larger firms, Sheng noted.

However, data for December -pointed to a slowdown in lending, which has prompted speculation that liquidity will remain tight in 2014.

In December, banks issued 482.5 billion yuan worth of new yuan loans, lower than November's 624.6 billion yuan. Growth of the broad measure of money supply M2 also slowed to 13.6 percent year-on-year by the end of December from 14.2 percent in the previous month, PBC data showed.

In a research note sent to the Global Times Wednesday, Bank of America Merrill Lynch said the slowdown in December was partly due to "a seasonal fall in loan demand," as lenders need to hold more cash at year-end to meet regulatory requirements.

"We expect the government to maintain neutral monetary and fiscal policies in the next couple of quarters while increasing their efforts in drafting and carrying out structural reforms," the note said.

Sheng also said Wednesday that the central government will continue to implement a prudent monetary policy in 2014 and conduct fine-tuning at appropriate times.

However, Zhang Zhiwei, chief -China economist at Nomura, said the data for December had broadly confirmed his view that "the monetary policy stance has tightened."

"The government may continue the tightening trend in the first half of 2014, and GDP growth may also slow slightly," Zhang told the Global Times Wednesday, saying that the tightening move is intended to further "deleverage the economy and support the econo-mic restructuring."

Sheng noted that key financial data for 2013 was "broadly in line with the government's target." Though China's M2 remains high compared to its peers, it does not mean that there is "oversupply" of the currency. The "high saving rate" in China is part of the reason for the high M2, Sheng said.

In 2013, the social financing aggregate reached a historic high of 17.29 trillion yuan, up 9.7 percent year-on-year. But the growth was slower than the 23 percent growth in 2012, which some experts said was partly due to the government's tighter regulations for the country's "shadow banking" sector.

"The central bank will strengthen regulations and supervision of shadow banking," Sheng said.

The PBC data also showed that China's foreign exchange reserves rose by $157 billion in the fourth quarter of 2013, reaching $3.82 trillion.

"Hot money inflow pressures could still be strong at the moment," said the research note from Bank of America Merrill Lynch.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.