The size of local governments' direct debts in China has grown beyond their capacity to repay them, pushing the central government to provide additional fiscal resources to deal with the problem, ratings agency Moody's Investors Service said Monday.

The National Audit Office (NAO) released a report on December 30 saying that China's total local government debt had reached 17.9 trillion yuan ($2.96 trillion) in June 2013, up 67 percent from the end of 2010. The amount of direct debt was 10.9 trillion yuan in June last year, the NAO said.

Whether the NAO figures "reflect more thorough accounting procedures or an actual sharp rise in debt, or both, this sizable accumulation in local government debt will be a burden on and carry risks to central government finances," Moody's said in a press release.

The NAO report shows that the maturity structure of local government debt is relatively near term, Moody's noted, which suggests that China's local and central government gross financing needs to keep growing.

Zhu Lixu, a Shanghai-based analyst with Xiangcai Securities, told the Global Times Monday that he agrees with Moody's, adding that the central government has to ensure smooth cash flows at the local level to prevent a credit crunch from happening.

"The central government will gradually reduce the amount of the current local government debt while offering help at the local level, and it will tightly control further growth of the debt. If not, the central government will face a huge burden in the future," Zhu said.

About 62 percent of the outstanding local government debt needs to be repaid from the second half of 2013 till 2015, the NAO said. A total of three provinces, 99 cities, 195 counties and 3,465 townships had debt exceeding local fiscal revenues and some of them used at least 20 percent of new borrowings to repay old debts, the auditor said.

China's local government debt poses a risk for the central government, but it will remain under control, Katie Chen, a Beijing-based analyst with Moody's, told the Global Times Monday.

"The recent announcements made by the government show the central and local governments have been contemplating ways to solve the local debt problem," she noted.

"Local governments will likely see more diversified sources of funding in the future. And a local government bond market, which would add transparency, efficiency and accountability, may be created," said Chen.

The central government could possibly expand its trial program of allowing local authorities to levy a property tax, Chen said, but a comprehensive national database of home owners' information is needed first.

China has introduced a slew of potential measures for local governments to rein in their soaring debts.

One of the most recent moves came on December 31, 2013, when the country's top economic planning agency, the National Development and Reform Commission, said that some qualified local government financing vehicles could issue new bonds to refinance their debts and to fund uncompleted infrastructure projects.

Chen said this move shows it is important that strategically vital projects can continue to get funding, because steady and healthy economic growth is a key priority for the central and local governments.

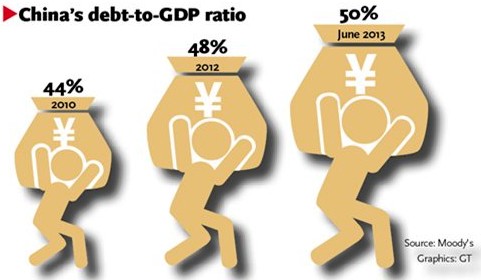

Moody's estimated that the amount of central and local government debt was equivalent to 50 percent of China's GDP in June 2013, up from 48 percent in 2012 and 44 percent in 2010.

China's debt-to-GDP ratio is still within a bearable range, Zhu said, but its rapid growth is disturbing and this problem urgently needs to be solved.

"Local governments need to pay high interest rates to borrow money but wait for long periods of time for their infrastructure projects to produce financial returns, so their debts will keep increasing," Zhu said. "If the ratio gets near 60 percent, it would jeopardize local economic stability."

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.