Although oil demand will continue to increase globally, it will become the fuel with the slowest consumption growth because of structural changes in the energy sector, experts said.

China will surpass the United States, becoming the largest oil consumer in the world in the following years, according to the Annual Development Report on Global Energy, which was released by the International Energy Research Center of the Chinese Academy of Social Sciences in Beijing on Thursday.

However, China's oil consumption per capita will not increase significantly because the share of petroleum in the country's fuel consumption structure is 20 percent lower than in other emerging countries, the report said.

"China may implement a series of measures to curb petroleum consumption growth including raising taxes in the transportation sector and encouraging the use of other kinds of energy as substitutes for petroleum," it said.

Guo Haitao, associate dean of the School of Business Administration of the China University of Petroleum, said that the country's petroleum consumption growth in recent years mainly comes from the industrial and transportation sectors.

However, as energy efficiency increases because of technology improvements in the industrial sector, the transportation sector will become the major driver for petroleum consumption growth, he added.

At the same time, developed countries have reached the peak of their petroleum consumption in 2005, and their demand for the commodity will decrease.

According to an estimate by the Paris-based International Energy Agency earlier this year, global petroleum consumption will increase 930,000 barrels a day to 90.8 million barrels a day in 2013 due to growing demand from emerging economies such as China and India. However, demand from the US will stay flat compared with last year, while Europe will see a 1.7 percent drop year-on-year in its oil consumption.

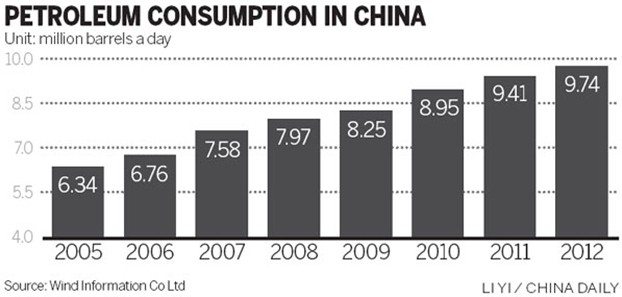

The report said that China's petroleum consumption will reach 10 million barrels a day this year, up 405,000 barrels a day from last year.

In terms of investments in the oil and gas sector, up to 80 percent are going to the upstream exploration business. This is the sector with the highest risks as well as the highest profits, said Guo.

"Chinese companies should be warned about the systemic risks when they make overseas investments in oil and gas businesses," he said.

Chinese energy companies are also changing their strategies to expand abroad from individual projects to consortiums.

"After more than 20 years of overseas investment experience in the oil and gas business, Chinese companies have widened their horizons from traditional oil and gas fields to unconventional energy such as shale oil, shale gas, coal bed methane and liquefied natural gas," said Wang Zhen, deputy head of the China University of Petroleum. "Meanwhile, they're becoming increasingly mature and adopting more diverse investment strategies such as mergers and acquisitions and asset exchanges."

"The participation of financial institutions in Chinese energy companies' overseas investments has accelerated their expansion in foreign markets, but also raised the level of systemic risks that we should pay attention to," said Guo.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.