Reform of the often volatile stock market is front and center of the country's new financial plans, but whether frauds and fears can be cleared up remains to be seen after authorities end a 13-month freeze on IPOs.

The country closed the IPO window in November 2012 in order to investigate fraudulent information released by companies and their proxies, and in hopes of boosting low stock prices.

China currently has an approval-based IPO system, where the securities market regulator decides if companies can go public and evaluates if they can stay profitable. Many criticized the regulator for unfair treatment of smaller and privately run companies compared with large State-owned enterprises.

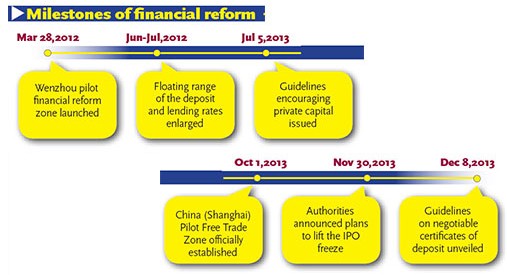

The China Securities Regulatory Commission (CSRC) published detailed guidelines on November 30, saying that it will lift the IPO freeze in January, and shorten its company application review time from as long as a few years to just three months.

The regulator also tightened rules for backdoor listings, raising the hurdles for companies to go public by buying a shell company.

Before the long-waited lift of the 13-month moratorium on IPOs, the CSRC led a six-month investigation into IPO candidates' financial reports. More than 30 percent of companies queuing up for IPOs decided to withdraw their applications during on-site inspections.

IPOs ‘set for record year‘ in 2014

2013-12-17IPOs to resume after a yearlong freeze

2013-12-01IPO reboot may see over 50 firms raise $7.2 billion

2013-12-17Seal of approval for new IPO rules

2013-12-17Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.