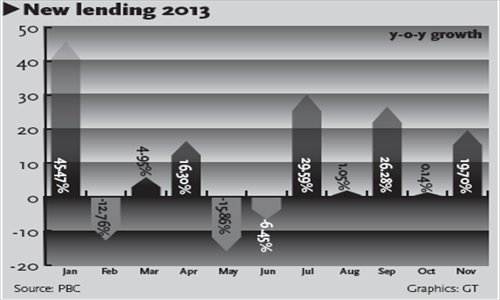

New lending growth

New bank lending in China quickened in November and a broad measure of liquidity accelerated sharply, adding to signs the economy is regaining momentum and relieving market fears of monetary policy tightening.

Banks made 624.6 billion yuan ($102.88 billion) worth of new yuan loans in November, higher than a forecast of 590 billion yuan and well above the previous month's 506.1 billion yuan, data released on Wednesday by the People's Bank of China (PBC) showed.

China's total social financing aggregate, a broad measure of liquidity in the economy, jumped to 1.23 trillion yuan in November versus 856.4 billion yuan the month before.

Rising money market rates and bond yields indicate the central bank is committed to deleveraging the economy by tapping the brakes on liquidity conditions, but there is little sign of a sharp turnaround in monetary policy.

"China's money and credit showed steady growth in November, reflecting robust demand for credit as the economy is on track for recovery," Jiang Chao, analyst at Haitong Securities in Shanghai, was quoted as saying on Wednesday.

"We expect total new yuan loans for this year to reach 9 trillion yuan and the annual figure for next year will be around 9-9.5 trillion yuan."

The broad M2 money supply rose 14.2 percent last month from a year earlier, the central bank said in a statement on its website, www.pbc.gov.cn, in line with the forecast in a Reuters poll.

M2 growth this year looks almost certain to surpass the central bank's target of 13 percent. It is widely expected to stick with the same target in 2014.

Outstanding yuan loans rose 14.2 percent from a year earlier versus forecasts for growth of 14.1 percent.

Earlier data showed China's annual inflation unexpectedly eased to 3 percent in November, cooling market fears of any imminent policy tightening as authorities meet this week to outline their policy and reform priorities for 2014.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.