China Southern Power Grid is a leader in the nation's push for infrastructure co-operation in neighboring countries'

As China's GDP growth is slowing, the expansion of economies in Southeast Asia is accelerating - creating demand for more electricity.

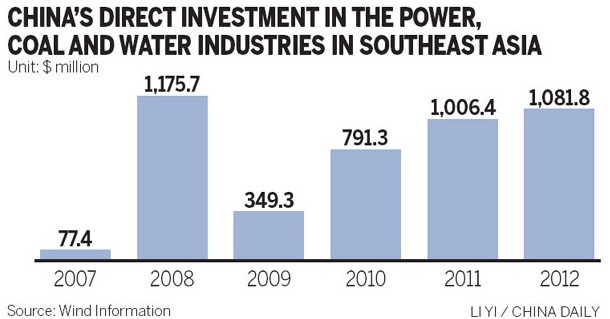

That disparity has opened opportunities for China's electricity sector, which is investing in generation and grid operations in those faster-growing markets, even as it continues to sell them power produced within China.

A recent development on this front comes from China Southern Power Grid Co Ltd, one of the nation's two major operators of electricity transmission and distribution systems.

On Oct 13, CSPG was awarded the contract for a coal-fired power plant in Yongxing, Vietnam, valued at $1.76 billion. It's the largest such deal in Vietnam for a Chinese company.

As China and Vietnam seek closer economic and trading bonds, the two countries will start key infrastructure projects soon that will support bilateral investment and trading, Premier Li Keqiang said during a visit to Vietnam in October.

The coal-fired power plant that CSPG will build is part of Vietnam's seventh power industry development plan. It's also a key infrastructure project.

Work is expected to start next year and be completed in 48 months.

The plant has an estimated operating life of 25 years, according to the company.

Deng Xiaowen, director of the international department of CSPG, said the company has been expanding overseas through two main methods.

One is direct investment, such as building power plants locally. The second involves transmitting electricity to foreign users, which is considered a form of exports.

"In the next 10 years, CSPG's overseas expansion will continue to focus on the Greater Mekong Subregion," said Deng.

"Building up a unified power market in the Mekong, as well as Macao and Hong Kong, will help these regions utilize resources better to boost their economies."

CSPG is already exporting electricity to Vietnam, Laos and Myanmar.

In September 2004, the grid operator began delivering electricity to Vietnam via six transmission lines, accounting for 5 percent of Vietnam's total power consumption.

As of the end of the last year, China had delivered 24.9 billion kilowatt-hours of power to Vietnam, aiding its economic development.

But Vietnam is still short of electricity. In the past 10 years, the country's economy has grown 5 to 7 percent annually, more than in prior years, causing big power shortfalls.

According to the government of Vietnam, the power shortage will reach 2.7 billion kwh in 2018.

Soaring electricity demand has burdened the power transmission lines in Vietnam, so the government is considering building new power plants.

"Capital and technology are the two obstacles to the development of Vietnam's power industry," said Dai Bing, a senior energy analyst at JYD Online Corp, a Beijing-based bulk commodity consultancy.

"The domestic companies (there) don't have the ability to invest in such huge projects, so it means introducing foreign investment is the best choice."

Investing in power plants in Southeast Asia is a good choice for Chinese companies, he said.

"China's economic growth is slowing, and the government is stressing alternative energy source. Together, that's meant relatively stable rates of increase in power demand in China.

"With a saturated power market in China, companies need to find new growth points," Dai said.

"Countries in Southeast Asia, which have growing power shortages, are a good choice for Chinese companies to make such investments."

In addition to being geographically near, those countries offer other advantages for Chinese investors as well. Their governments welcome power projects, so investments easily win approval, said Dai.

More important, because of the low consumption levels in these countries, the costs of raw materials such as coal and water are low, he said.

"Compared with China's domestic power plants, it's profitable to invest in hydropower plants and coal-fired power plants in many Southeast Asian countries because of the low prices of water and coal," he said.

Four days after CSPG won the deal in Vietnam, it signed an agreement in Laos to build five electricity transmission lines and four transformer substations. Construction is to start by the end of 2015.

CSPG has been delivering electricity to Laos for 10 years, working with local company Luang Namtha Power Co.

Singshamouth, deputy director of the Luang Namtha Furniture Wood Processing Factory, which was founded in 1990, said that diesel power generators could only support two workers at the very beginning. Since 2003, thanks to electricity imported from China, the company has grown. It now has 35 workers, and output is growing by 10 percent annually.

Yunnan Power Grid Corp, a subsidiary of CSPG, is based just over the border from Laos. It was supplying power to the Southeast Asian country even earlier, starting in 2001.

State Grid Corp of China, the world's largest utility company, also has made rapid moves in its overseas expansion, with several mergers and acquisitions. It has taken stakes in power companies in Brazil, Portugal and Australia in the past two years.

Han Xiaoping, chief information officer of the China Energy Net Consulting Co Ltd, said those overseas M&As can improve the company's profitability by allowing it to enter more foreign markets.

"The Chinese company has advanced transmission technology and management skills, which will greatly help with the local power supply," he said.

In 2011, China Three Gorges Corp, a State-owned power generator, bought about 21 percent of Energias de Portugal SA, a major power company in Portugal.

"The increase in domestic power companies' overseas acquisitions results from China's attempt to institute market reforms in its power sector," said Han.

China's major grids and power generators have been stepping up their foreign expansion by purchasing foreign power companies and investing in local power plants.

CSPG's Deng believes that's wise, as he thinks that electricity exports should not become China's major energy export channel.

"China is a huge economy with growing energy demand for both oil and power. Since electricity is 'derived energy,' which consumes a large quantity of primary energy and imposes environmental costs during its production, it is not a good idea to deliver electricity directly as an energy export," he said.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.