![Lenovo displays its new smartphone at PT/Expo Comm China 2013 in Beijing. The electronics company is making an aggressive push to expand its reach in the Southeast Asian markets. [Photo / China Daily] Lenovo displays its new smartphone at PT/Expo Comm China 2013 in Beijing. The electronics company is making an aggressive push to expand its reach in the Southeast Asian markets. [Photo / China Daily]](U468P886T1D85217F12DT20131022102049.jpg)

Lenovo displays its new smartphone at PT/Expo Comm China 2013 in Beijing. The electronics company is making an aggressive push to expand its reach in the Southeast Asian markets. [Photo / China Daily]

World's biggest PC producer is establishing a stronger presence in Southeast Asia in an effort to become a global giant

Southeast Asia is turning into a key battleground for electronics vendor Lenovo Group Ltd as the world's biggest personal computer company pursues a stronger global presence.

The region's 600 million people, and the optimistic economic outlook for the Association of Southeast Asian Nations, offer a "golden opportunity" for the Beijing-based company to build a next-generation profit model, even as the global PC market declines, company executives said.

Growing demand on the consumer electronics front is Lenovo's best asset in the 10 ASEAN countries. These markets run the gamut from Indonesia, the world's fourth most-populous nation, to Singapore, the richest city-state in Asia.

About 60 percent of Lenovo's ASEAN revenue comes from the consumer market, and the company aims to build on that strength in the coming years.

Chen Xudong, a senior vice-president at Lenovo, said that the consumer electronics market in ASEAN has huge potential, and companies that are best-placed to provide the most suitable products will make huge profits in the coming years.

"ASEAN is an extremely diversified market, because each country has its own distinctive advantages as well as weak points," said Chen, adding that Lenovo must carefully study every market to gain a bigger presence.

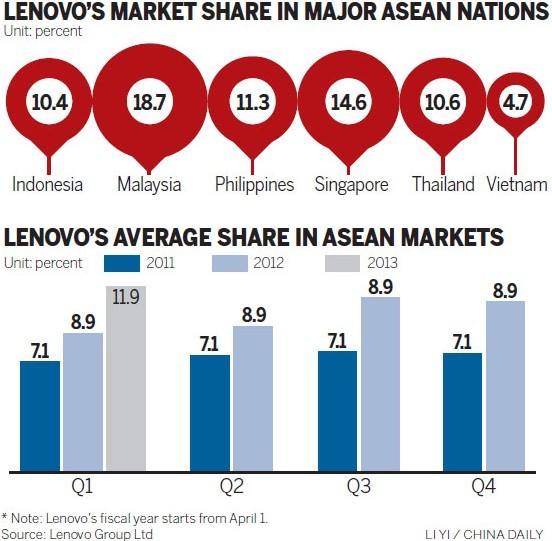

Out of the eight markets where Lenovo's share of PC sales stood in double digits as of June, five were in ASEAN. The company has a market share of nearly 20 percent in Malaysia, the highest in the region.

For the region as a whole, Lenovo is the third-largest PC vendor. Taiwan-based PC maker Acer Inc is the leading brand, with a 15.2 percent market share, followed by ASUSTeK Computer Inc, with 12.6 percent, according to research firm IDC.

Lenovo's market share in ASEAN reached a record high of 11.9 percent during the first quarter of the new fiscal year, which started in April. Its market share was 8.9 percent a year earlier.

Chen said: "Our next goal is to get double-digit market shares in more ASEAN countries, and we're trying to build a stronger brand image in key markets such as Singapore, Thailand and Indonesia."

Atop Funan Digital Mall, the busiest electronics shopping center in downtown Singapore, hangs a 5-meter-tall banner featuring the Yoga, Lenovo's flagship tablet. Samsung's Galaxy Note banner flies alongside it.

Lenovo owns two exclusive outlets in the mall, with each generating quarterly revenues in millions of Singapore dollars.

"Singaporeans are aware that Lenovo is a Chinese company," said Jessie Quek, head of the company's Singapore unit, adding that consumers are willing to buy more made-in-China electronics compared with previous years.

"In addition, Lenovo is getting more press attention in both developed nations and emerging markets in Southeast Asia," said Quek.

"Chinese IT firms, especially Lenovo and Huawei Technologies Co, are among the most vigorous players in exploring overseas markets in recent years," said Zeng Jianqiu, a

professor at the School of Economics and Management of the Beijing University of Post and Telecommunications.

"I think Lenovo realized the importance of overseas markets after the acquisition of IBM's PC business for $1.25 billion nearly a decade ago. The acquisition also accelerated the company's expansion process outside China," said Zeng.

Post-PC strategy

Chen said that Lenovo is looking beyond the PC industry, which is experiencing a record decline.

Worldwide PC shipments fell 11 percent in the second quarter of this year, said the United States-based consultancy Gartner Inc.

Southeast Asia won't be immune to this trend, as thriving sales of tablets and other mobile devices will continue to erode the PC's territory.

"We are vigorously exploring future revenue boosters while the PC unit is still able to generate strong and steady income," according to Chen.

"PC plus" is how Lenovo executives describe the new era. The company was caught in the middle of the PC downturn just as it became the world's biggest maker of the product.

In spring 2012, Lenovo Chief Executive Officer Yang Yuanqing introduced the "PC plus" strategy to prepare the company for the mobile era.

Lenovo has released smartphones, tablets and other consumer electronics products as it aims to take part in the mobility market.

The company aims to sell 100 million smart terminals, including smartphones and tablets, by the end of 2013. Overseas markets could contribute nearly half of those sales.

During the first quarter, 100,000 Lenovo smartphones were sold in Southeast Asia, said the company.

But because of the unique market landscape in different countries, Lenovo must learn new strategies to tap into new markets.

In Singapore and other developed markets, contract phones could take more than a 90 percent share, because competition among telecommunications carriers is extremely intensive, according to Quek.

"Vietnam only has a second-generation network, so most of the customers are price-sensitive," said Chen.

Demand in Indonesia overall is similar to other developing nations, while in Jakarta, its capital and richest region, smartphone buyers are more interested in higher-end devices despite higher price tags, said Chen.

"When people think of ASEAN, they see 10 countries. But for Lenovo, which is determined to expand in each of the ten markets, we have to carefully examine demand and appreciate the uniqueness [of each market] to beat competitors," he added.

Executives at Lenovo are keen about their "attack and protect" strategy, part of which involves the company's smartphone, tablet and smart TV products.

The company aims to lure buyers who are willing to spend more than 3,000 yuan ($490) for a smartphone. In September, it released the VIBE X, an entry-level high-end product targeting young adults.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.