Chinese outbound investment will become more diverse in both target markets and fields in the coming year, according to a report released by global consulting firm Ernst & Young on Tuesday.

Going global is necessary for the sustainable development of Chinese companies, said the report, titled China Outbound Investment Trends and Prospects.

The firm forecast economic growth of 8 percent in 2014.

"As China's domestic economy reflects a slight recovery, Chinese capital inflows to developed and developing economies will increase simultaneously next year," said Fabian Wong, a partner in E&Y's China overseas investment department. Wong is in charge of businesses in the European, Middle East, Indian and African markets.

For the first eight months, China's non-financial overseas direct investment increased 18.5 percent year-on-year to $56.5 billion, according to the Ministry of Commerce.

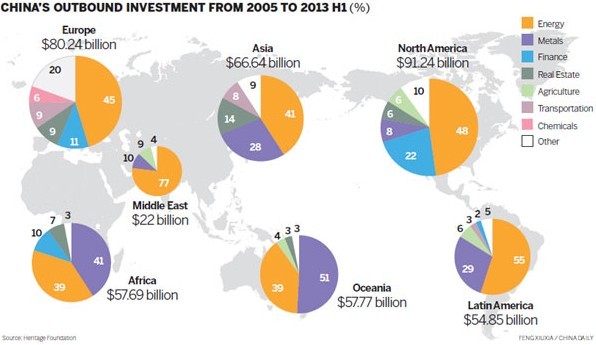

North America, Europe and Asia were the top destinations for China's outbound investment in the first half, the E&Y report shows.

Wong said that Chinese investors continue to reaffirm their interest in the European markets this year. That's especially true of the nation's State-owned enterprises, which have become the driving force in investment. Private-sector companies also have a strong appetite for fast-appreciating assets in the region, but they lack a clear focus in terms of strategy and execution.

Emerging economies in Europe such as Turkey are gradually becoming new investing destinations for Chinese companies, Wong said.

Australia is another attractive market for Chinese investors, with private-sector companies taking a more active role in the market, the report said.

"Although resource-related transactions still dominate Chinese investment, Chinese investors have broadly expanded into sectors such as agriculture, real estate, renewable energy, power and utilities in Australia," John Li, partner at E&Y's China business group Oceania, said.

Australia's new government has launched a major infrastructure plan, attracting great interest from Chinese engineering companies, Li said.

During an interview with China Daily, Peng Yali, director and head of research of KPMG Global China Practice, said that the major destinations of China's overseas direct investment are shifting among different regions, as Chinese companies are increasingly interested in infrastructure investment and other sectors.

E&Y's report has found that China's outbound investment is diversifying beyond energy. For the first half of the year, the energy and metals sectors accounted accounted for 64 percent of such investment, down from 78 percent in 2009.

Meanwhile, overseas investment in agriculture and technology saw a dramatic increase, representing 15 percent of total value, compared with 4 percent in 2009.

"Agribusiness and food processing will be a highlight in China's future overseas direct investment," said Peng.

Wong said that Chinese companies may need to reconsider their asset portfolios and seek a more balanced risk management threshold. They should also consider moving up the value chain to compete more effectively with counterparts from Southeast Asia, Japan and South Korea. While going abroad to tap international markets, Chinese companies face challenges from both the external environment and internal management.

KPMG said that China's outward direct investment in the near future is likely to face a phase of adjustment and the pace may slow after the fast growth in the past decade.

The slowdown and occasional fluctuations could be opportunities for Chinese companies to reflect on their strategies for improvement while the overall trend of China's ODI will grow, accord to KPMG.

In 2012, China ranked third among all economies in terms of outward foreign direct investment flows. The country's outward direct investment into non-financial sectors stood at $77.73 billion, up 13.3 percent, according to the 2012 Statistical Bulletin of China's Outward Foreign Direct Investment.

"Insufficient understanding of local cultures may lead to labor disputes for Chinese enterprises. Chinese enterprises should also be aware of the concerns of local governments, communities and non-governmental organizations" while maintaining good partnerships with host governments.

"Their standards in business operations should be higher than local standards, especially regarding soft laws," Sean Gilbert, director of climate change and sustainability at global consultancy KPMG, said.

"When Chinese enterprises extend their reach to overseas markets, better coordination in corporate management should be introduced to ensure smooth communication and supervisions between the overseas branches and the headquarter," Gilbert added.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.