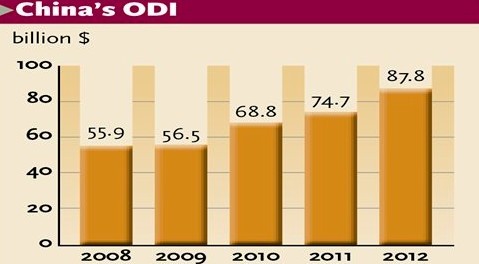

China's outbound direct investment (ODI) reached a record high of $87.8 billion in 2012, making the country the third-biggest outward investor last year, data released Monday by the nation's statistics and commerce authorities showed.

The world's second-largest economy saw growth in ODI of 17.6 percent in 2012, even though the total global ODI dropped by 17 percent during the same period according to the data, co-published by the Ministry of Commerce, the National Bureau of Statistics and the State Administration of Foreign Exchange.

"China has always had excess industrial production capacity, and Chinese businesses have been looking for investment opportunities overseas," said He Weiwen, co-director of the China-US-EU Study Center under the China Association of International Trade.

China's accumulated ODI volume stood at $531.9 billion at the end of 2012, ranking 13th worldwide. That amount was equivalent to 10.2 percent of the US volume and 29.4 percent of the UK volume, because "China's ODI took off fairly late" compared with developed countries, the report said.

"Considering the production capacity and the government's eagerness for China to go global, the country's ODI will keep growing," He told the Global Times Monday. "I think China's ODI will go over $90 billion this year."

Domestic investors and firms had invested in nearly 22,000 companies in 179 countries and regions as of late 2012. And the country's ODI to the US increased by 123.8 percent year-on-year in 2012 to hit $4.05 billion, making the US the second-largest ODI destination for China, the announcement said.

Zuo Xiaolei, chief economist at China Galaxy Securities, told the Global Times Monday that another reason for the surge in the country's ODI last year was that the financial crisis had dampened developed countries' ability to conduct ODI, thus offering more investment opportunities to Chinese firms.

"As developed nations, such as the US and the UK, were trying to deal with their own economic problems, they did not have a big appetite to invest in developing countries," Zuo said. "So many Chinese businesses grabbed the opportunity to invest in markets such as Greece."

The report also said that China achieved a record high of 457 mergers and acquisitions with foreign companies last year, with an actual transaction value of $43.4 billion.

Li Shi, a professor at Beijing Normal University, told the Global Times Monday that another reason for the rise in China's ODI is that many private companies have accumulated a lot of cash after decades of development.

"Chinese companies used to be short of cash but many of them, especially private ones, are rich enough to go overseas. At the same time, foreign companies ran out of cash due to the financial meltdown and needed investment from Chinese firms," Li said.

He said that the nation's ODI will likely surpass the flow of foreign direct investment into China in the next few years.

China 2012 ODI hits record high

2013-09-09China's ODI hits $50.6b, up by 20 percent

2013-08-23ODI to retain fast growth in H2: ministry

2013-07-18China vaults to world's 3rd-largest investor

2013-09-10Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.