Honeywell International Inc decided in June to move its Beijing office from a building in Liangmaqiao, a busy street in the eastern part of the city that runs off the Third Ring Road, to Jiuxianqiao, near the northeastern Fifth Ring Road.

The relocation will allow the multinational corporation to consolidate all its Beijing employees at one location in a new office building with nearly 15,000 square meters of space. It also brings the technology company near other industry giants.

What's more, the rent in Jiuxianqiao will be about half as much as in Liangmaqiao, which is near many high-end hotels, apartment buildings and embassies.

A Honeywell manager said the relocation will begin in the second half of this year. The company hopes that the consolidation will improve working efficiency.

Honeywell isn't alone in making this type of decision. In the past few years, driven by ever-rising downtown rents, more multinationals in China have moved their Beijing or Shanghai offices to cheaper locations. Many more are considering such moves.

Some companies made that decision years ago, such as Motorola Inc and IBM Corp, which shifted their offices before the 2008 financial crisis.

But now, so many multinationals are following this path that real estate consultants Cushman & Wakefield said in a recent report that it's become a trend.

Cost is a major concern, of course. According to C&W's data, as of the second quarter of 2013, office rents had increased 43 percent in Shanghai and an astonishing 138 percent in Beijing compared with 2009.

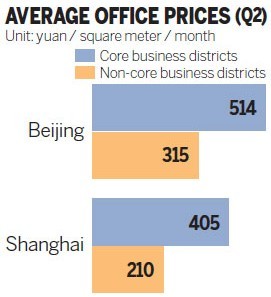

Grade-A office buildings in Beijing's non-core areas are 30 percent cheaper than similar buildings in core areas. In Shanghai, the difference is almost 50 percent.

In some cases, cost isn't the only issue. Beijing's and Shanghai's central business districts are increasingly crowded and there are few available offices left.

For example, in Beijing, the core-submarket vacancy rate declined from 20.7 percent at the end of 2009 to just 4.2 percent in the second quarter of this year. This means that even if multinationals are willing to pay the high rents in core areas, they may find it difficult to get extra space.

At the same time, Beijing's and Shanghai's non-core business districts have higher vacancy rates and building owners are more than willing to offer discounts to premium clients.

As multinationals expand in China, they also find it necessary to put their back-office business, such as research and development, logistics and data management, in suburban areas. For example, banks may prefer to put their headquarters in Beijing's Financial Street, near major regulators and other financial institutions. But they might find it attractive to locate their call centers in suburban areas.

As more corporations move to non-core submarkets, rents there will also rise.

Zhang Ping, director of C&W's Beijing research operations, drew a comparison between Hong Kong and the first-tier cities on the mainland.

Five years ago, major corporations in Hong Kong started their retreat from the Central business district, which has the most expensive office space in the world. Kowloon, on the other side of the harbor, became a popular alternative. The result was an upswing of rents in Kowloon, while rents in Central declined 16.8 percent year-on-year in 2012.

"Rents in Beijing's CBD are unlikely to see such a drop in coming years. But rents in non-core areas will certainly rise," said Zhang.

However, Andy Zhang, managing director of C&W China, warned that moving to a suburb is not a one-size-fits-all solution.

When corporate executives consider the option of moving, they should think of whether a new office location would affect their current business operations, Zhang said.

Grade A office rents in Puxi and Pudong mixed in Q2

2013-07-11Premium office rents in first-tier cities stay high

2013-07-10Landmark theater rents out floor to luxury brand

2013-06-26Demand pushes up rents in Beijing

2013-06-14Grade A office rents under pressure after years of rises

2013-05-13Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.