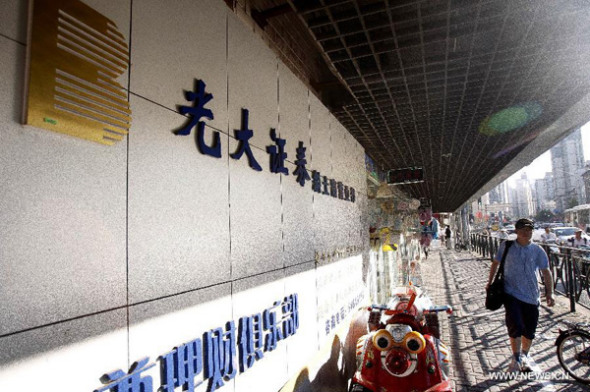

A man walks past a brokerage house of Everbright Securities Co., Ltd., east China's Shanghai, Aug. 16, 2013. The Shanghai Stock Exchange (SSE) said Friday afternoon that the investment strategy department of Everbright Securities Co., Ltd. had encountered a problem in its arbitrage system while operating with its own funds during the morning trade at the bourse, following a dramatic spike in domestic stock indexes. (Xinhua/Ding Ting)

A securities commission spokesman said Friday that the commission is probing abnormal deals made by Everbright Securities during Friday's morning trading.

The China Securities Regulatory Commission (CSRC) and the Shanghai Stock Exchange (SSE) are jointly investigating a large number of purchase orders sent from the Everbright Securities' trading account, a CSRC spokesman said at a press conference.

The stock market saw its greatest fluctuation in six years on Friday. In late morning trading, the benchmark Shanghai Composite Index spiked by around 100 points, or 5 percent, within two minutes, with turnover totaling 7.8 billion yuan ( 1.27 billion U.S. dollars).

A number of bank and oil shares, including the Industrial and Commercial Bank of China and PetroChina, rose near the daily limit of 10 percent.

Everbright Securities Co., Ltd. said in a Friday statement to the Shanghai Stock Exchange that its investment strategy department encountered a problem in its arbitrage system while operating with its own funds during morning trading.

Trading of Everbright shares, which rose 6.69 percent in the morning amid big gains in the financial sector, was suspended on Friday afternoon.

Early gains for Chinese shares were almost erased during afternoon trading, with the Shanghai Composite Index closing down 0.65 percent.

Following the abnormal deals, there was market speculation that Everbright Securities may have applied to cancel all morning trades.

SSE said in the afternoon that all Friday trading will go through the normal settlement and entrustment process.

Mei Jian, secretary of Everbright's board of directors, denied rumors of a possible trade cancellation application, adding that the company has accepted SSC's decision.

Mei also denied a rumor that the company's internal simulated trading system was used in real trading, resulting in an abnormally large amount of purchasing orders.

Mei said the company's arbitrage system will not be used again until the company finds out how it failed.

"The company's other systems are functioning normally, " Mei said.

Mei said Everbright uses its own funds for trading, so the incident did not incur any losses for its clients' capital.

"We are probing the case and have seen some developments. But it will take more time to come to a correct and complete conclusion," Mei said.

Stock analysts said Friday's incident demonstrated the existence of loopholes in the trading process used by Chinese brokerages.

A Howbuy Fund research team said China's regulatory body and institutional investors should strengthen risk control and management, adding that they must not underestimate risks brought by small incidents in the financial market.

A report from Wanglong Securities said Friday afternoon's large falls indicate that the market remains weak.

The China Financial Futures Exchange said Friday that the stock-index futures market is operating normally.

Deposits will be enough to cushion Friday's fluctuation, it said.

Stock-index futures contracts allow investors to bet on and profit from either gains or declines in the market.

Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.