China's automobile market showed an unexpected strong momentum with double-digit growth in the first half of the year, making it likely that total sales in the world's largest vehicle market will exceed the 20-million unit barrier for the whole year.

However, Chinese automakers are facing challenges because of slowing exports, as well as increased competition from foreign rivals, which may result in production cuts, analysts said.

The latest figures from the China Association of Automobile Manufacturers showed that in the first six months, China's total automobile production and sales both exceeded the 10-million unit barrier for the first time ever, with a year-on-year growth of more than 12 percent, outstripping the association's previous expectations.

The association attributed the robust momentum to the sales surge in the passenger vehicle sector, led by sedans and sports-utility vehicles. From January to June, China delivered 8.66 million passenger vehicles in total, up 13.8 percent year-on-year, according to the association.

Significantly, the sales increase was "propelled by the top international joint ventures that dominate the passenger vehicle market," said Namrita Chow, a Shanghai-based senior analyst with consulting firm IHS Automotive.

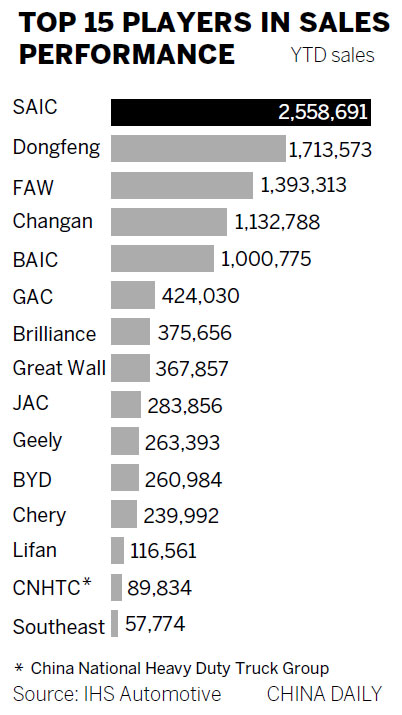

"The figures count total wholesale vehicle sales from 70 automakers in China, among which the top players remained the major State-owned automakers with strong international joint ventures, led by Shanghai Automotive Industry Corp and followed by Dongfeng Motor, FAW Group, Chang'an Auto and Beijing Automotive Industry Corp," said Chow.

"SAIC continues to dominate the market, but relies on its joint ventures with Volkswagen and General Motors for the bulk of its sales," Chow added.

The CAAM statistics also showed the combined sales of the country's top 10 automakers accounted for 88.15 percent of the total amount, 0.9 percentage point higher than in the same period last year.

"The industry's concentration rate is still increasing because the top players are making efforts to have stable and sustainable growth," said Jia Xinguang, an independent Beijing-based auto analyst.

"They are well on track to achieve the target set by the Ministry of Industry and Information Technology recently, which asked for the top 10 automakers to contribute 90 percent of overall domestic sales by 2015."

The SUV category saw a year-on-year growth of more than 40 percent in the first half with deliveries of 1,329,788 vehicles, while sedan sales also saw solid growth in the period, up 11.69 percent year-on-year to 5,841,270 cars. The multi-purpose van segment surged 128.18 percent from a year earlier to 567,524.

"The SUV segment has seen dramatic changes in the first half. The mainstay Japanese brands, which previously enjoyed strong growth, saw an increased loss of market share while other brands have seen a sudden hike," said Chow.

Audi's SUV models, built under the FAW-Volkswagen joint venture, have seen strong growth, as the brand introduced the Q3 model to its lineup in addition to the existing and larger Q5. In the first six months, Audi SUVs saw sales of 60,220 units, up 43.91 percent year-on-year.

Mercedes-Benz's SUV model, the GLK, which is built by the Beijing-Benz local plant, saw sales of 17,628 units in the first half, up 158.4 percent from last year.

Chow believes that SUVs will continue to see strong growth while sedan sales growth will moderate in the second half of the year.

Dong Yang, general-secretary of the CAAM, said the association is still keeping its "earlier estimate of a 7 percent annual growth for 2013, with overall sales of 20.8 million units, because there are still many uncertainties in the market in the second half". However, Cui Dongshu, deputy secretary-general of the China Passenger Car Association, was more optimistic and estimated an 18 percent year-on-year vehicle sales growth.

IHS Automotive forecasts an annual production growth of 10.4 percent in China in 2013, with total production to reach 20.4 million vehicles.

Exports slow down

The Chinese vehicle export market saw fabulous growth in 2012, with the total number of vehicles exported for the first time outstripping the 1 million unit barrier, up 29.7 percent on an annual basis.

However, in the first six months, the market saw a rapid slowdown. A decline of 29.16 percent in June made the first half increase sharply drop to 2.29 percent from the same period last year, with 294,283 vehicles exported.

Chery Automobile Co - China's top exporter - saw the number of vehicles exported drop 24.82 percent to 68,246 in the period, while the country's second-largest exporter, Zhejiang Geely Holding Group Co Ltd, saw exports drop 28.64 percent.

"Chinese automakers are facing challenging times with declining sales for most local brands. With the decline in exports, these brands will now likely look to cut production," said Boni Sa, a light vehicle production analyst at IHS Automotive.

More cities consider car limit

2013-07-18China auto sales pick up in H1

2013-07-11Auto sales curb may spread to more Chinese cities

2013-07-10Copyright ©1999-2018

Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.