CEO Mackenzie sets his sights on conventional oil, LNG and shale gas

The new chief executive of BHP Billiton, the world's biggest mining company by market capitalization, says the company is preparing itself to become a more diversified energy and resources player, in order to adjust to global economic conditions.

Andrew Mackenzie, a Scot who officially took the helm of the company last week, said BHP has a number of exciting options for the future, including in conventional oil and gas, liquefied natural gas and more recently shale oil and shale gas.

"I will work with our new team to understand how best to invest in petroleum in the future and what weight to place in those areas," he said during an interview in Beijing.

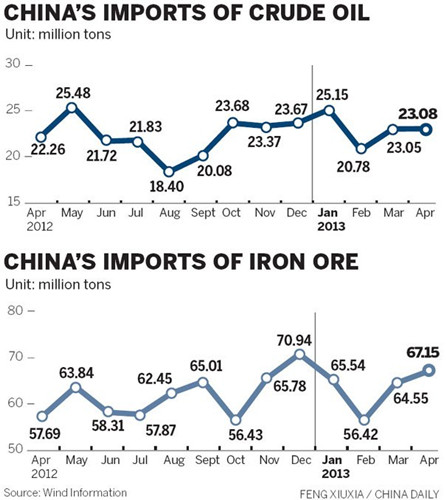

As the world's largest iron ore consumer, China's demand for the commodity has been slowing considerably, which has affected the production and investment plans of producers around the world, forcing many to seek other opportunities to ensure profitability and long-term sustainable development.

The Wall Street Journal earlier this week reported that BHP is planning to reduce its capital expenditure "quite significantly" in coming years as a result of the world slowdown, with some suggesting that could be by as much as a fifth.

But speaking to China Daily, Mackenzie said that BHP has specific plans for China.

"It's very appropriate that my first public duty as CEO of BHP is to come here to the home of our most important customers," he said.

"China will want to import petroleum products to fuel its growth moving forward.

"The next phase of planned growth envisages an increase in domestic consumption, and that will almost certainly lead to a strengthening in demand in oil and gas, coal and possibly uranium," he said.

To meet those demands in China, Mackenzie said BHP's diversified investment in its energy businesses will ensure what he called a plentiful and fairly priced energy supply to an economy which he said he is confident will continue to grow.

According to the General Administration of Customs, China imported 271 million metric tons of crude oil last year, a rise of 6.8 percent compared with the previous year, as demand remained high despite the economic slowdown.

According to industrial analysts, around 60 percent of China's oil demand will depend on the overseas market by 2020.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.