Medtronic's chief executive officer presents his vision for growth in the Chinese marketplace

Omar Ishrak is a typical businessman - he loves to speak methodically and systematically, drawing on numbers and facts.

During his first meeting with the Chinese media, the chairman and chief executive officer of Medtronic Inc said his company intends to continue to grow at 20 percent or 25 percent a year in China in the future.

The US-based medical technology business operates in more than 120 countries. Global revenue was $16.2 billion in the fiscal year 2012, of which 55 percent was from the United States and only 10 percent from emerging markets, including China.

"There are three universal healthcare needs defined by us and we will buttonhole two unique strategies (to deal with them)," said Ishrak, who took up his current position in June 2011 from GE Healthcare, where he was president and chief executive officer.

The professional manager summarized the three needs as improving clinical outcomes, expanding access and providing cost-effective therapies and solutions. The consequence is the generation of economic value and globalization are set to be two key developing strategies of Medtronic in the coming years.

Ishrak presented himself in a clear, brief and solid manner, in the same fashion in which he conducts his work - in a straight, ambitious, aggressive and object-targeted fashion.

Aggressive moves

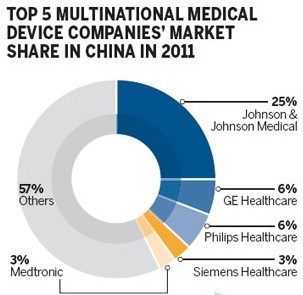

Under his leadership, Medtronic spent nearly $900 million in just one month last year on two merger and acquisition deals in China, making a record in transaction volume not only in terms of foreigners' M&A in China but also in the medical device industry in 2012. It was an aggressive step for a healthcare company to advance its globalization and expand its local presence and accelerate access and competencies in China.

Medtronic completed the acquisition of China Kanghui Holdings, a Jiangsu-based orthopedic devices manufacturer, for $816 million in cash in early October last year. In mid-September it announced the purchase of a 19 percent initial equity investment in Shenzhen-based LifeTech Scientific Corp, a cardiology invasive intervention device provider, for $46.6 million and a $19.6 million convertible note representing an additional 7.4 percent equity.

Ishrak said the primary M&A focus in China is to get low-cost access customizing for the unique needs of Chinese patients. "Secondarily, we think they (M&As) can be used as an export base out of China into other emerging markets," he added.

A sharpened focus on globalization is something new that Ishrak brought to Medtronic as its new chief nearly two years ago.

"I think globalization is not an option. It's a must (for Medtronic)," he repeated several times. "It doesn't matter whether you know us. It doesn't matter how uncomfortable it would be in a different environment. It doesn't matter what risks you might have to take."

Medtronic invented the pacemaker for people with heart problems. Its business now has been expanded in cardiology, diabetes and therapies, which include orthopedics, neurology as well as other surgical tools.

Unlike the strategies of other medical device providers in emerging markets - such as the development of cheaper products - the initial focus of Medtronic's globalization is to provide its current therapies to people who can already afford them. The company estimates the strategy is worth $5 billion a year in opportunities.

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.